Or a loss of 30 billion, the world's largest offshore wind power developer abandoned two major projects in the United States

There is bad news for the wind energy industry in Europe and the United States.

On November 1, local time, Danish wind power developer Ørsted announced that it has decided to stop developing offshore wind power projects Ocean Wind 1 and Ocean Wind 2 in New Jersey, USA.

Ørsted said the decision was mainly due to supply chain challenges that led to delays in project schedules, continued interest rate hikes in the United States, and expected adjustments to tax subsidies and approvals.

According to the New York Times, Msted Energy Group president and CEO Mads Nipper said at the earnings conference that the losses at the New Jersey project would only grow over time, so "the only sensible thing to do is to draw the line."

The abandonment of these two projects may lead to a write-down of assets of more than 30 billion yuan for Ørsted Energy.

In the third-quarter results report released on the same day, Ørsted Energy recorded a total of about 28.4 billion Danish kroner (about 29.6 billion yuan) of asset write-downs, of which 19.9 billion Danish kroner (about 20.8 billion yuan) is related to the Haifeng 1 project.

Ørsted expects another 8 billion to 11 billion Danish kroner (8.3 billion to 11.5 billion yuan) write-downs related to the abandonment of the U.S. sea wind project in the fourth quarter.

Ørsted is the world's largest developer of offshore wind power and is listed on the Nasdaq Copenhagen Stock Exchange. In the third quarter of this year, the company recorded a loss of 22.6 billion Danish kroner (about 23.5 billion yuan), compared with a profit of 9.4 billion Danish kroner in the same period last year.

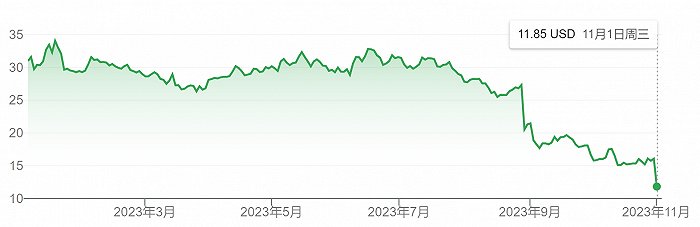

The market's unexpected asset write-down caused the company's share price to plunge more than 26% on the day. As of the close of trading on November 1, local time, Ørsted Energy was quoted at $11.85 per share, down 61.8% from the beginning of the year.

This is not the only bad news for the wind energy industry in Europe and the United States in recent times. Wind power supply chain challenges due to the inability of European and American manufacturers to keep pace with growing market demand, coupled with equipment security and soaring interest rates, have led to delays or financial problems for many wind projects.

Ørsted announced in late August that it was delaying construction of the Seawind 1 project, saying that its wind projects elsewhere in the U.S. were affected by the same negative factors as Seawind 1.

At least a dozen offshore wind projects in the U.S. and Europe have been delayed or stalled in the past few weeks, the Wall Street Journal reported on August 7. The total planned expenditure for these projects is about $33 billion.

In October, US regulators in New York rejected requests from offshore wind developers such as BP, Equinor and Ørsted to raise offshore wind charges.

On October 31, local time, bp included US$540 million (about 4 billion yuan) of pre-tax impairment charges related to offshore wind power projects in the United States in its public third quarterly report.

Nowhere is the financial challenge more acute than Germany's Siemens Energy.

On October 26, local time, Germany's Der Spiegel Online website reported that Siemens Energy is seeking guarantees from the German government.

On the same day, Siemens Energy issued an announcement confirming that the company is seeking guarantees, including preliminary negotiations with various stakeholders, including banking partners and the German government.

The company also warned that revenue from its wind power business, Siemens Gamesa, would fall short of market expectations, with a higher net loss and cash outflows.

This is the second time in recent months that Siemens Energy has issued a profit warning. In August this year, huge losses were caused by the quality of onshore wind turbines.Siemens Energy has lowered its forecast for fiscal 2023。

The above news caused Siemens Energy's stock price to plummet nearly 40% on the same day. As of November 1, Siemens Energy's stock price has fallen by more than 50%.