Falling below 40%, CATL's market share hit a 17-month low in September Power battery monthly ranking(32)

In September, CATL's (300750.SZ) domestic power battery market share hit a 17-month low.

On October 11, the latest data released by the China Automotive Power Battery Industry Innovation Alliance showed that CATL (300750.SZ) still topped the list with a loading volume of 14.35 GWh in September, but its market share was 39.41%, which fell below 40% again after March last year. BYD (002594.SZ) ranked second with 9.83 GWh of installed vehicles, with a market share of 27%.

In September, the total market share of the above two leading power battery companies was 66.41%, down nearly 5 percentage points from the previous month. In the same period, the sum of the market share of the third to tenth places in the ranking was 31.06%, an increase of 4.77% from August.

From January to September, the cumulative loading volume of domestic power battery companies shows that CATL and BYD are still in the top two, with market shares of 42.75% and 28.94% respectively.

China Innovation Airlines (03931.HK) ranked third with a market share of 10.06% with a market share of 3.66 GWh in September, the second highest this year. EVE (300014.SZ) ranked fourth with 1.84 GWh of installed capacity, with a market share of 5.06%, an increase of more than 1.5 percentage points from the previous month, ending a four-month decline.

Gotion Hi-Tech (002074.SZ) and LG Energy Solution, which ranked fifth and sixth, had 1.47 GWh and 1.28 GWh of installed vehicles in a single month, respectively, and their market share increased compared with August. Among them, LG Energy Solution hit a new high for the year with a market share of 3.52%. Honeycomb Energy, Sunwoda (300207.SZ), Zhengli New Energy, and Funeng Technology (688567.SH) ranked seventh to tenth, respectively.

In September, the domestic power battery installed volume was 36.4 GWh, a year-on-year increase of 15.1% and a month-on-month increase of 4.4%.

Among them, the loading volume of ternary batteries was 12.2 GWh, accounting for 33.6% of the total installed volume, and the installed capacity of lithium iron phosphate batteries reached 24.2 GWh, accounting for 66.4% of the total installed volume.

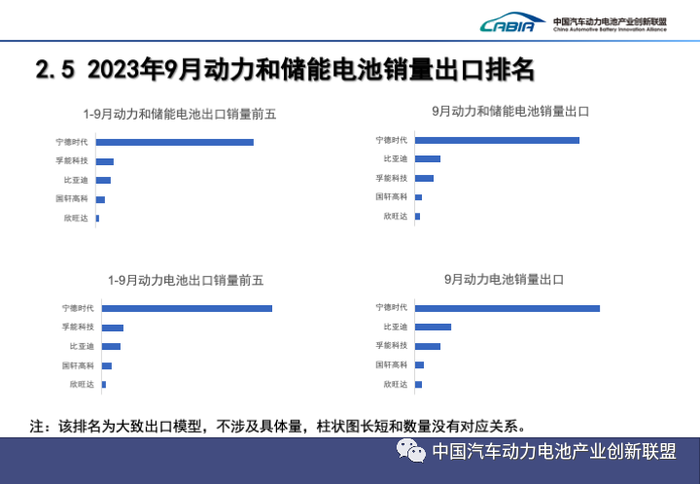

In terms of exports, China's power and energy storage battery exports totaled 13.3 GWh in September, with ternary batteries and lithium iron phosphate batteries.

Lithium iron phosphate and ternary batteries are the two mainstream routes of domestic power batteries. From 2018 to 2020, the loading volume of domestic lithium iron phosphate batteries was lower than that of ternary batteries. With the help of innovative technology, the advantages of lithium iron phosphate in terms of safety and cost are becoming more and more prominent. In July 2021, the market share of lithium iron phosphate batteries surpassed that of ternary batteries, and it has maintained its leading position since then.

Judging from the export ranking of enterprise battery sales in September, CATL is far ahead, and BYD, Funeng Technology, Guoxuan Hi-Tech, and Xinwangda rank second to fifth respectively.

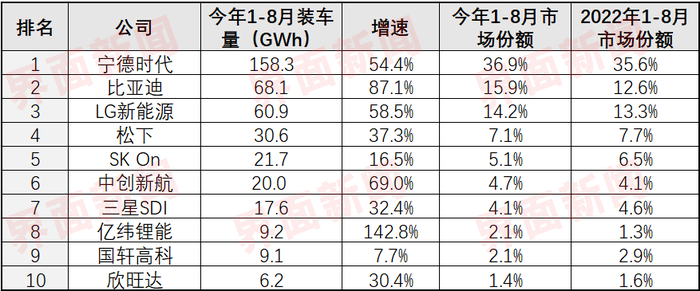

South Korean research institute SNE Research also released the latest power battery statistics on October 11, from January to August this year, the global installed capacity of power batteries was 429 GWh, a year-on-year increase of 48.9%.

In the first eight months of this year, the gap between Chinese and South Korean companies in terms of market share widened to 39.7 percent, compared with 33.7 percent in the same period last year.

CATL and BYD ranked first and second with market shares of 36.9% and 15.9%. China Innovation Airlines' global market share further increased to 4.7%, a difference of 0.4% from its predecessor, SK On, and a decrease of two percentage points from the same period last year.