Yan Lei: How can the carbon market bring "extra" benefits to the environmental protection industry?

In the "2020 (14th) Solid WasteStrategic ForumYan Lei, senior manager of the carbon trading center of the Beijing Green Exchange, delivered a speech on the theme of "How the carbon market brings "extra" benefits to the environmental protection industry. He said that the carbon offset mechanism based on CCER is a very innovative design of the carbon market. CCER projects are usually from wind power, photovoltaic and forestry carbon sink projects, but are not limited to these types.Sewage treatment、Waste incinerationCCER can also be provided in seemingly unrelated areas such as household biogas, which allows traditional environmental projects to obtain "additional" benefits through the carbon market.

Yan Lei

The basic situation of the development of carbon trading in China

Since September this year, General Secretary Xi Jinping has made six commitments at international conferences that China will strive to peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060. This is also the most ambitious and largest quantitative goal made by China so far after the Paris Agreement, and China's energy utilization, utilization efficiency and low-carbon transformation of economic structure are all on the way.

Time is tight, and the task is heavy. However, reducing carbon dioxide emissions is not an easy task, and carbon trading is one of the important policy tools involved in all aspects of economic development.

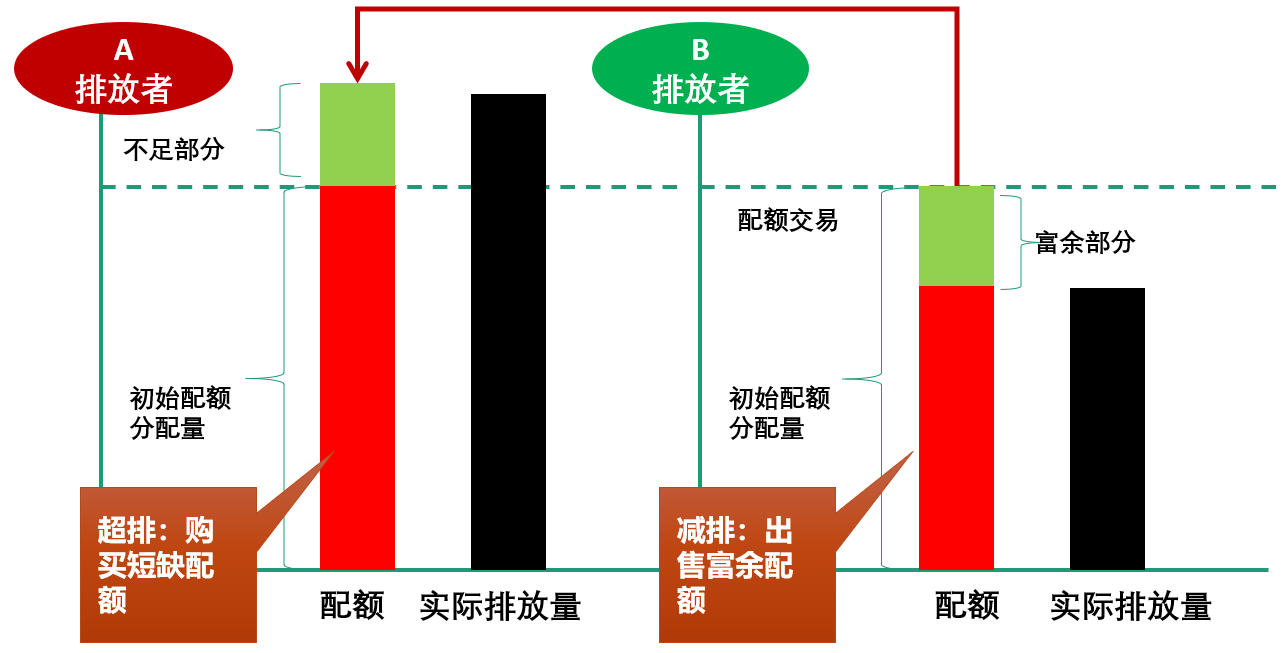

Yan Lei首先介绍了碳交易的基本原理。假设市场中有A、B两类排放者,政府主管部门给他们分配相同的碳排放量配额各100万吨,A企业一年的碳排放量为110万吨,超过了规定配额10万吨,而B企业一年碳排放量为90万吨,距离达到规定配额还剩余10万吨排放空间。在下一年度碳交易履约时,政府会要求两类企业上交与上一年度排放量相等的配额,那么,A企业就可向B企业购买富余的10万吨配额完成履约任务,否则将会面临惩罚。市场中进行碳排放交易的两类企业数量多了,碳排放交易所的作用随之体现,可提供公平的交易平台,收取交易佣金,完成线上、线下的撮合交易。

The mechanism of carbon trading

At present, there are 38 countries and regions around the world that have launched or plan to launch carbon markets, including eight provinces and cities in China carbon trading pilots, California and nine eastern states in the United States (RGGI, regional greenhouse gas reduction action), Quebec in Canada, Tokyo and Saitama Prefecture in Japan, as well as the European Union, Switzerland, New Zealand, South Korea and Kazakhstan, a total of 19 relatively independent markets. In addition, national and regional governments such as Mexico, Brazil, Chile, Ukraine, Turkey, Thailand, and Washington have publicly expressed their consideration of establishing an emissions trading system.

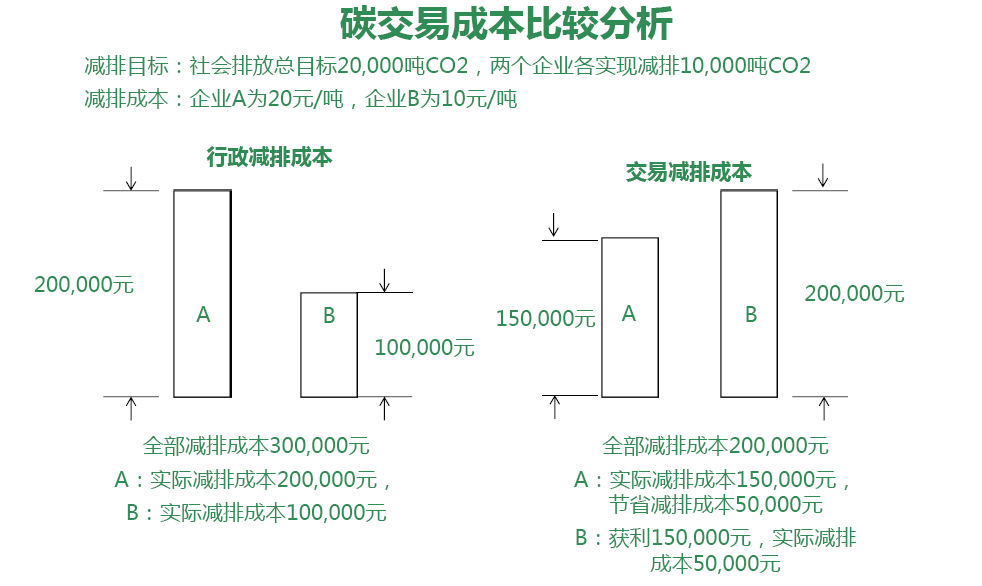

为何碳排放交易体系可以如此快的建立起来?Yan Lei解释到,假设社会排放总目标为2万吨CO2 ,A、B两家企业需要各实现1万吨CO2 。但现实中需要考虑每个企业的减排成本是不一样的,假设A企业减排成本为20元/吨,B企业为10元/吨。那么行政减排成本为A企业20万元,B企业10万元,全部减排成本为30万元。如果在碳交易市场,两家企业以一个合适的价格进行碳交易之后,在市场中找到一个合适的交易价格为15元/吨,那么A企业的实际减排成本为15万元,与原来相比,节省成本5万元。B企业再多减排一万吨,将一万吨的配额以市场价15元/吨售出给A企业,则可获利15万元,实际减排成本则为5万元,A、B企业全部减排成本加起来为20万元。这样一来,双方企业都可有效降低减排成本,全社会的减排成本也随之降低,政府也愿意看到这种局面。

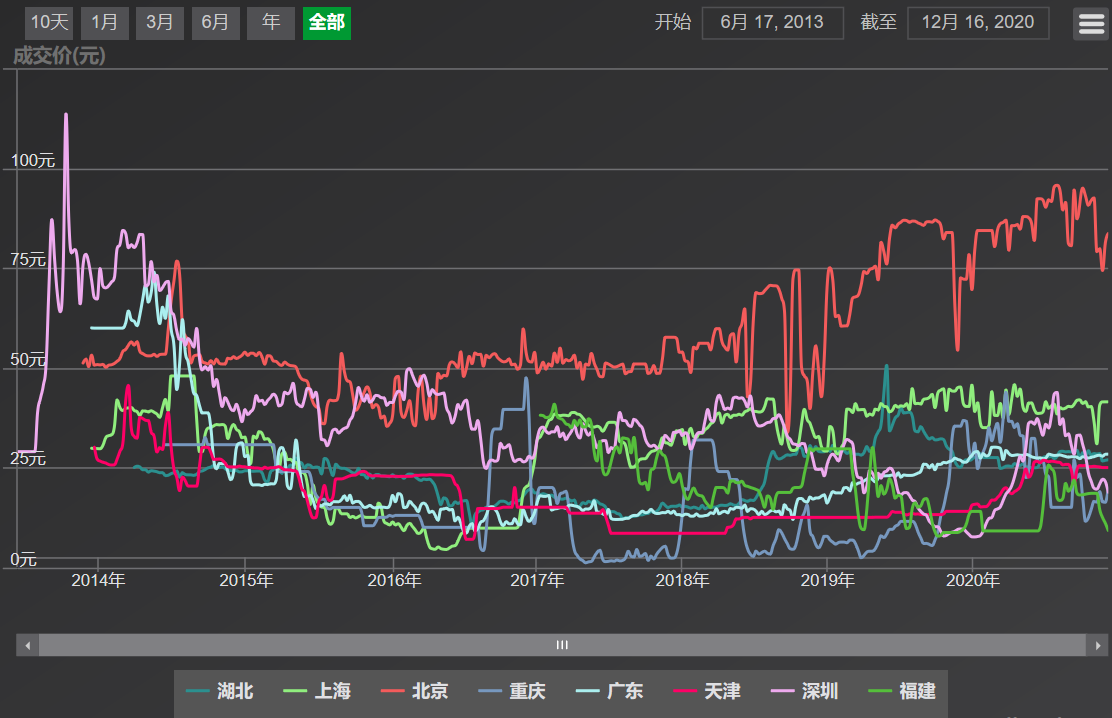

Looking back on the development history of carbon trading, in the early days, the successive promulgation of the Kyoto Protocol, the "CDM Project Operation Management Measures" and the "Greenhouse Gas Voluntary Emission Reduction Trading Management Measures" contributed to the early development of China's carbon trading market; From 2011 to 2012, China was in the preparatory stage of regional pilots; Since 2013, China is in the regional pilot stage, and has established a total of 8 pilot projects in Hubei, Shanghai, Beijing, Chongqing, Guangdong, Tianjin, Shenzhen and Fujian; After 2020, China may officially operate a national carbon trading market.

Yan Lei补充道,由于各地经济发展水平不同,碳试点政策设计的严格程度不同等原因,碳配额价格有较大的差异,例如北京经济发展水平较高,其单位减排成本比较高,所以碳配额价格达到近100元/吨的水平。

Allowance trading prices in the domestic pilot market (data source: China Emissions Trading Network)

Domestic carbon offsets and the latest policies

What is a carbon offsetting mechanism?

In our countryCarbon reductionIn this context, it is difficult for every industry and enterprise to stay out of the situation, so how should the traditional environmental protection industry participate in the carbon market and can it benefit from it?

对此,Yan Lei解释到,基于CCER的碳抵消(Carbon Offset)机制,是碳市场一项非常创新的设计,是指控排主体在履约过程中,从碳市场购买一定数量的Carbon reduction信用(CCER)来抵消自身碳排放的整个过程。这样就为CCER项目(自愿减排项目)业主创造了“刚需”,而这些项目通常来自风电、光伏和林业碳汇等项目,但又不仅限于这些种类型,Sewage treatment、Waste incineration、户用沼气这种看似不相干的领域一样可以提供CCER,这种传统的环保项目可以通过碳市场获得“额外”的收益。

举例来说,在抵消比例为5%的碳市场,假设A企业的碳排放配额是100万吨,实际排放量是110万吨,针对缺口的10万吨排放量,企业可以先在碳交易市场购买5万吨配额,剩下的5万吨可以购买Waste incineration、Waste to landfill和Sewage treatment等CCER项目完成履约。