Can the BC cell technology promoted by LONGi Green Capability really subvert the photovoltaic industry?

Interface News Reporter | Ma Yueran

Interface News Editor | Zhang Hui

The photovoltaic industry, which has been silent recently, has been dominated by the leading LONGi Green Energy (601012.SH).Earnings briefings"Stirred" lively. Battery technology has once again become a hot topic of discussion in the industry.

"LONGi has a very clear view that in the next 5-6 years, BC cells will be the absolute mainstream of crystalline silicon cells, including bifacial and monofacial cells. At yesterday's performance meeting, Zhong Baoshen, chairman of LONGi Green Energy, said in response to a question about the selection of battery technology, so LONGi's next planned investment projects will all use BC technology.

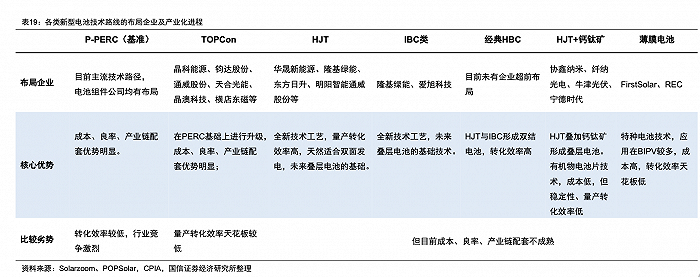

This assertion immediately detonated the market. In the past two years, as the efficiency of P-type cells has approached the limit, N-type technologies have come to the fore, mainly including TOPCon, heterojunction (HJT), BC technology, etc. In contrast, the industrialization of TOPCon and HJT is more popular, and the industrialization process of TOPCon is faster, and a large number of new production capacity is betting on TOPCon technology.

LONGi Green Energy has not made a clear statement on the future route selection of photovoltaic cells before, and chose the current "non-mainstream technology" as soon as it made a move, and at the same time denied the future trend of TOPCon, which caused heated discussions in the market.

BCWhat is a battery?

BC type battery (back contact battery) is a platform structure that can be combined with a variety of routes.

In an interview transcript obtained by Jiemian News, Professor Shen Wenzhong, director of the Solar Energy Research Institute of Shanghai Jiao Tong University and honorary chairman of the Shanghai Solar Energy Society, said recently that traditional PERC cells, as well as conventional structures such as TOPCon, heterojunction, and tandem cells, are distributed with grid lines on the front and back of the battery, which need to be turned on on both sides, but the two types of bus lines of BC cells are on the back, that is, the front of the module using BC cells is not blocked by grid lines.

It is generally believed in the industry that BC structure cells have more prominent advantages in distributed photovoltaics due to their beautiful appearance.

Looking back on history, in the 70s of the last century, SunPower, founded by a professor at Stanford University in the United States, proposed a cross-finger BC structure, named IBC, and began to industrialize in the 80s and 90s. In 2014, SunPower's IBC cell production capacity reached 1.2 GW per year, including a third-generation high-efficiency IBC cell production line with an annual capacity of 100 MW.

According to Shen Wenzhong, BC technology can theoretically superimpose various battery technologies, such as PERC, TOPCon, heterojunction, tandem cells, etc.

For example, HBC cells (Heterojunction Back Contact) combined with HJT and IBC cells, TBC cells combined with TOPCon and IBC, etc.

TOPCon, HJT, and BC technologies have their own advantages and disadvantages. According to Jiemian News, TOPCon batteries are compatible with the PERC cell process and can be transformed and upgraded based on PERC production lines, which greatly reduces the investment cost and depreciation cost of equipment, which helps TOPCon take the lead in this round of N-type wave. However, the disadvantage is that the space for improving the efficiency of mass production is relatively small, and there are still process route disputes. At the same time, due to the large number of current entrants, the competition has been fierce.

业内一直有声音认为,TOPCon是过渡技术。钟宝申在此次Earnings briefings上表示,TOPCon和传统PERC电池相比,效率提升幅度太小,行业技术方面高度同质化,容易出现未赚钱就过剩的现象,且现在已经有这种苗头。

Compared with PERC and TOPCon, heterojunction technology has fewer process steps, high bifaciality, easy lamellaria, and is more suitable for perovskite technology stacking, so there is a lot of room for efficiency improvement in the future. However, the cost of consumables such as silver paste and target used in this type of battery is high, and the number of entrants is not as large as that of TOPCon, so the cost reduction rate is slow.

"Because the metal grid will block part of the sun, the BC cell technology will be relatively more efficient. Shen Wenzhong said that at the same time, because there is no grid on the front, BC cells are more beautiful and more suitable for distributed photovoltaics, but the difficulty of manufacturing this kind of cell is more challenging, and the quality of silicon wafers is higher.

Shen Wenzhong said that BC batteries have not been developed before, largely because the cost of the battery structure lithography process used by SunPower is very high, which has limited popularization.

"With the rapid development of domestic enterprises and the effective solution of process problems, the BC battery market prospect is promising. Shen Wenzhong thinks.

In November last year, LONGi Green Energy launched HPBC technology products for the distributed market, and later decided to invest in the construction of an annual HPBC cell production capacity of 30 GW.

HPBC stands for composite passivated back contact battery, which is the fusion result of P-type TOPCon technology and IBC technology. LONGi's choice of P-type and BC technology is largely due to its strong P-type wafer production capacity.

Shen Wenzhong said that the BC structure can be combined with various battery technologies. In the future, more efficient cell technology must be the development model of perovskite + heterojunction + BC structure.

Why is LONGi betting?

LONGi Green Energy's great efforts on BC batteries seem unexpected, but it is reasonable.

According to the current layout of various enterprises, LONGi Green Energy has lost the opportunity in the TOPCon and heterojunction routes, and can only be a "follower". If it wants to maintain its top position, LONGi really needs a new story.

In the past two years, the photovoltaic industry has carried out a lot of research and discussion around battery technology, and the iteration of new photovoltaic cells has accelerated.

In this round of competition, JinkoSolar (688223.SH), one of the leading companies, took the lead, and when many companies were still wavering, they were firmly optimistic about TOPCon technology and quickly entered the mass production stage.

JinkoSolar's decision has triggered a leading effect, coupled with the cost advantage of TOPCon, making it the best choice for companies. Whether it is many "cross-border players" or leading enterprises, most of them choose TOPCon technology for expansion.

According to InfoLink, TOPCon nominal capacity is expected to increase to nearly 500 GW by the end of 2023.

However, there are also a few companies such as Huasheng New Energy and Risen Energy (300118.SZ), which are more optimistic about the efficiency and other advantages of heterojunction, so they choose the heterojunction route.

In such an industry background, LONGi Green Energy, the industry leader known as "photovoltaic Mao", has not made a statement, but has always claimed to have a layout for a variety of technical routes. From various public occasions this year, the company's executives have frequently expressed the view that "TOPCon is a transitional product".

In February this year, LONGi Green Energy suddenly announced that its 30 GWOrdos battery projectThe TOPCon technology among the N-type technologies will be adopted. At that time, LONGi Green Energy told Jiemian News that it chose to launch TOPCon products at the right time.

"TOPCon was chosen to meet the needs of our customers. Although LONGi is not satisfied with TOPCon technology. Until better technology matures, LONGi can't stop and do nothing altogether. Li Zhenguo said to interface news and other media during the SNEC photovoltaic exhibition.

In other words, the company's production of the TOPCon project was forced to do something due to market demand.

In the last round of industry reshuffle, LONGi Green Energy became the global module and wafer leader by virtue of its early bet and adherence to the mono-Si route.

In this period of technological change, LONGi's "hesitation" has frequently aroused doubts in the industry. In a number of earnings meetings and media interviews, the company was asked whether it was too conservative and whether its business strategy was reasonable.

In addition, the stock prices of new energy photovoltaic related companies have fallen again and again this year, and they seem to have been abandoned by capital. LONGi's own share price has fallen by nearly 40% since the beginning of the year, down more than 60% from its historical high, and its market value has evaporated by nearly 300 billion yuan.

LONGi Green Energy announced its bet on the BC route at this point in time, bringing new attention to the market.

Zhong Baoshen said at the performance meeting that the company's 30 GW HPBC production capacity is expected to reach full production by the end of the year, and the monthly production capacity is expected to be 2.2 GW, that is, 25 GW for the whole year.

Zhong Baoshen also revealed that LONGi Green Energy's current research has three major directions, one is HBC combined with heterojunction, the second is the evolution route based on TOPCon, that is, N-type BC products, and the third is the current HPBC. As for which of the three routes has greater advantages, it seems that each is competitive at present.

Zhong Baoshen said that in the first half of the year, LONGi's HPBC production line has met expectations and is operating normally, but the shipment volume is not large, close to 1.5 GW, mainly because the ramp-up is more difficult than expected.

At present, LONGi HPBC mainly launches two standard power module products in 182 versions, including 590W and 580W.

Zhong Baoshen said that LONGi's HPBC focuses on single-sided products, because it will focus on rooftop products in the future Chinese market, emphasizing the advantages of single-sided and not targeting double-sided and ground-mounted power stations. However, if HPBC is made bifacial, the power generation capacity is equivalent to that of TOPCon.

LONGi Green Energy plans to launch a new HPBC Pro version by the end of next year, which has better performance and advantages in both single and double sides, facing ground power stations and launching it on a large scale in 2025.

"Next year's HPBC shipment target is to strive for all the products to be sold, and the premium in the market is 1-1.5 cents/W compared with TOPCon." Zhong Baoshen said.

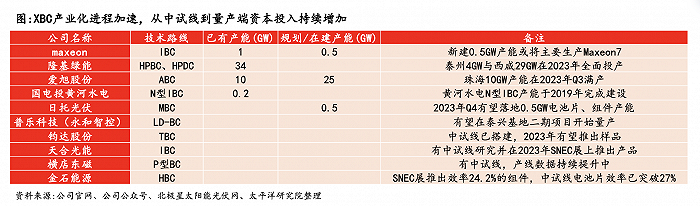

Which companies are in the layout?

On the night that LONGi Green Energy announced the BC battery route, TCL Zhonghuan published an article on its official account titled "Insight into the Future of the Industry, Differentiated Technology Route Boosts the Development of the Industry", implying that it has laid out BC battery technology.

It is mentioned that TCL Zhonghuan has cooperated with SunPower, the predecessor of Maxeon, since 2012, and will participate in the spin-off Maxeon company in 2020. Maxeon has 1,483 patents and 412 pending patent applications in various countries and regions around the world, and has broken the world record 11 times.

SINGAPORE, June 1, 2023 /PRNewswire/ -- Maxeon unveiled a new record for its full-size Maxeon 7 modules using back-contact (IBC) cell technology, achieving a bore efficiency measurement of 24.7%.

TCL Zhonghuan said that based on Maxeon's IBC technology, the intellectual property rights of shingled modules and technological innovation advantages, it will further enhance the company's overall global business competitive advantage.

However, TCL Zhonghuan also chose TOPCon technology first in its latest battery expansion plan.

Another representative photovoltaic company in the industry that takes the BC cell route is Aiko Co., Ltd. (600732.SH).

Aiko has a new generation of fully back contact solar crystalline silicon cells (ABC) independently developed by Aiko. The company has said that it is the world's first silver-free technology for photovoltaic cells, which solves the problems of low-cost large-scale mass production, bifacial power generation, and efficiency improvement of BC cells.

Based on ABC battery technology, Aiko has designed and launched a variety of styles of household ABC modules, including a full range of products such as double glass and double side.

According to the financial report for the first half of the year, up to now, the first phase of the 6.5 GW ABC battery project of Aiko Co., Ltd. in Zhuhai has been put into production, with an average mass production conversion efficiency of 26.5%. The ABC module using this cell technology can deliver 465W of 54-version modules and 620W of 72-version modules with a 182mm silicon wafer size, with a mass production efficiency of 24%.

According to Aiko, the power generation of ABC modules in the whole life cycle is more than 15% higher than that of PERC modules in the same area.

"The two BC technologies of Aiko and LONGi have their own characteristics." Some industry insiders commented on the interface news. "In terms of efficiency, Aiko may be higher, and LONGi may be better in cost.

According to this person's analysis, the biggest advantage of LONGi Green Energy's adoption of BC technology on the basis of P-type silicon wafers is that the aluminum on the back side can form an insulated aluminum backfield with P-type silicon wafers, and the foundation of the electrode can be realized with aluminum paste. Aiko's BC structure uses N-type silicon wafers, electroplating copper technology, and does not use relatively expensive silver paste.

In addition to the above three representative companies, Yonghe Intelligent Control (002795.SZ) once said on the investor interactive platform that its subsidiary Pule Technology has patented technologies for N-type TOPCon batteries and N-type IBC batteries.

Hengdian East Magnetic (002056.SZ) said in March this year that it participated in the research and development of P-IBC products earlier, which is very consistent with its market positioning, but it cannot be mass-produced at the current yield, and the follow-up depends on whether the yield can have a breakthrough, if the yield cannot be broken, it will slow down moderately.

On the whole, due to technical barriers and other reasons, there are still a few companies in the market that choose the BC route. Up to now, only LONGi Green Energy and Aiko have really embarked on the road of mass production.

Therefore, there is a view in the industry that it is expected that in a short period of time, it will be difficult for BC battery technology to subvert a large number of mainstream TOPCon production capacity. In addition, if the scale effect cannot be formed, the voice of BC battery manufacturers in the market is bound to be weak.

According to incomplete statistics from Jiemian News, the BC battery-related concept stocks on the battery module side also include JinkoSolar, Junda (002865.SZ), etc., because they have relevant technical reserves.

In addition, the BC battery-related concept stocks on the equipment side include Deere Laser (300776.SZ), Jeput (688025.SH), Robotec (300757.SZ), Innova Laser (301021.SZ), Hymson (688559.SH), etc., and other auxiliary materials include Kuangshun Materials (300537.SZ), Bofei Electric (001255.SZ), etc.

Affected by the news of LONGi Green Energy, the BC battery sector has continued to rise in the past two days. As of the close of trading on September 6, Kuangshun materials 20cm daily limit, up 40% in two days; Dier Laser rose 7.92%, Yonghe Intelligent Control opened with a daily limit, closing up 2.62%; Aiko shares rose 1.88%. However, LONGi Green Energy fell 0.82% to close at 27.87 yuan per share, with a total market value of about 211.3 billion yuan.