Analysis of the low-carbon demand of new energy vehicles for the steel industry

According to the Regulations on the Access of New Energy Vehicle Manufacturers and Products issued by the Ministry of Industry and Information Technology of the People's Republic of China on January 6, 2017, new energy vehicles refer to vehicles that adopt new power systems and are driven entirely or mainly by new energy sources, including plug-in hybrid vehicles (including range extenders), pure electric vehicles and fuel cell vehicles. As a strategic focus to meet energy and environmental challenges, new energy vehicles have become the backbone of promoting the transformation and upgrading of the automobile industry. The development of the new energy vehicle industry has also had an important impact on the steel industry. On the one hand, due to the structural differences between new energy vehicles and traditional fuel vehicles, such as battery packs instead of engines, gearboxes and other components, the overall steel consumption is slightly reduced. On the other hand, due to the pursuit of lightweight design of new energy vehicles to improve mileage and save energy consumption, the use of steel structure has changed, such as the use of more high-strength steel, ultra-high-strength steel and other lightweight materials. Therefore, the development of the new energy vehicle industry has put forward higher requirements for the steel industry, requiring iron and steel enterprises to increase research and development efforts, change product structure, and improve product quality and performance to adapt to market changes and needs.

The new energy vehicle industry has driven the production and sales of the steel industry

(1) The market size and trend of the new energy vehicle industry

According to the Global Electric Vehicle Outlook 2023 report released by the International Energy Agency (IEA), the global new energy vehicle market has shown exponential growth, with sales exceeding 10 million units in 2022 and a penetration rate of 14%. China, the United States, and Europe are the main drivers of global sales, with China ranking first, accounting for about 60% of global EV sales.

Source: CleanTechnica (BEV and plug-in hybrid)

According to the data of the China Association of Automobile Manufacturers, in 2022, the production and sales of China's new energy vehicle industry will be 7.058 million and 6.887 million respectively, an increase of 96.9% and 93.4% year-on-year, respectively, and remain the first in the world for eight consecutive years. From January to August 2023, the production and sales of new energy vehicles reached 5.434 million units and 5.374 million units, up 36.9% and 39.2% y/y, respectively, with a market share of 29.5%. From January to August, the domestic sales of new energy vehicles were 4.647 million, a year-on-year increase of 32%; NEV exports totaled 727,000 units, reflecting a 1.1-fold y/y increase. Compared with the same period last year, the production and sales of pure electric vehicles and plug-in hybrid vehicles increased to varying degrees, while the production of fuel cell vehicles decreased and sales increased.

The rapid development of the new energy vehicle industry has benefited from the relevant policy support and market demand driven by the continuous promotion of the state. The state has successively issued planning documents such as the "Energy-saving and New Energy Vehicle Technology Roadmap 2.0" and the "New Energy Vehicle Industry Development Plan (2021-2035)", which have clarified the development goals, technical routes and policy measures of new energy vehicles. Although the subsidy policy for new energy vehicles will be officially withdrawn in 2022, the government will continue the preferential policies such as exemption from vehicle purchase tax for new energy vehicles, and increase support for the construction of charging and swapping facilities, the promotion of intelligent network technology, and the formulation of energy conservation and environmental protection standards. At the same time, with the improvement of consumer recognition of new energy vehicles, the continuous improvement of product quality and performance, the continuous improvement of cruising range and safety level, and the increasing convenience of charging and swapping services, the market demand for new energy vehicles is also continuing to expand.

(2) The basic demand for steel in the new energy vehicle industry

Steel will be used in different components and structures of new energy vehicles, the most important of which are motors and bodies. The motor of new energy vehicles is the core component that converts electrical energy into mechanical energy, and needs to have the characteristics of high efficiency, high power density, and low noise. Therefore, the motor generally uses silicon steel sheet as the main material. Silicon steel sheet is a kind of low-carbon steel containing a certain proportion of silicon elements, which has high permeability and low iron loss, which can improve the performance and life of the motor. In addition, the body structure of new energy vehicles needs to meet the requirements of lightweight, high strength, and high safety, and materials such as low-carbon steel, high-strength steel, advanced high-strength steel, and hot-stamping steel will be used.

fig1 The basic demand for steel for new energy vehicles

Compared with traditional automobiles, the amount and structure of steel used in new energy vehicles are different:

(1) Dosage requirements:Compared with traditional vehicles, the biggest difference between new energy vehicles and traditional vehicles lies in the change of driving mode. Due to the large weight of the battery pack and the corresponding increase in the weight of the whole vehicle, the gap in the demand for steel is basically in the gap between the electric car group and the engine construction, and with the development trend of lightweight, intelligent and networked new energy vehicles, the amount of steel used in a single vehicle will gradually decline in the future. It is estimated that in 2025, about 65 million tons of steel will be used in automobiles, and in 2030, about 62 million tons of steel will be used in automobiles. Among them, the amount of steel used in new energy vehicles accounts for about 20% of the total steel consumption.

(2) Variety structure:New energy vehicles have higher requirements for the variety and structure of steel, and need more special steel grades such as high strength, high toughness, high thermal conductivity, and high corrosion resistance. Among them, non-oriented silicon steel has good magnetic properties and magnetic permeability, which can reduce iron loss and eddy current loss in motors, and the demand for core materials for motors and transformers has increased significantly. The market size of non-oriented silicon steel is expected to grow from $100 billion in 2020 to $140 billion by 2025. In addition, in order to achieve lightweight, energy conservation and emission reduction, new energy vehicles have used more high-strength steel and advanced high-strength steel, as well as some alternative materials such as aluminum alloy and magnesium alloy to reduce the weight of the vehicle and improve the mileage.

(3) Quality standards:New energy vehicles also have stricter quality standards for steel, which need to meet certain requirements such as mechanical properties, dimensional accuracy, surface quality, and internal quality. For example, non-oriented silicon steel requires properties such as low iron loss, high magnetic induction strength, and low hysteresis coefficient. In addition, new energy vehicles also need to meet certain environmental protection standards, such as low carbon emissions, low pollution, etc.

The impact of the new energy vehicle industry on the carbon reduction of the steel industry

(1) The development status of carbon reduction in the iron and steel industry

钢铁行业是全球最大的二氧化碳排放源之一,也是实现绿色低碳发展的重要领域。从国际角度来看,欧盟、日本、韩国等国家和地区都制定了较为明确和具体的钢铁行业减碳目标和路线fig,主要包括提高能效、增加废钢利用、推广碳捕集利用与封存(CCUS)、发展氢气直接还原炼钢(H2-DRI-EAF)等技术。例如,欧盟计划到2030年将钢铁行业的二氧化碳排放量较1990年水平降低30%,到2050年实现净零排放。一些钢铁企业也积极响应减碳目标,如瑞典的海德克(Hybrit)项目已经建成了全球首个以氢气为还原剂的试验性冶炼炉,预计到2026年实现工业化生产;德国的蒂森克虏伯(Thyssenkrupp)公司已经启动了一座以氢气为还原剂的中试规模冶炼炉,并计划到2050年实现钢铁生产过程的净零排放。

From a domestic point of view, China's iron and steel industry in the "13th Five-Year Plan" period to further promote the supply-side structural reform, resolve excess capacity has achieved remarkable results, the industrial structure is more reasonable, green development, intelligent manufacturing, international cooperation has made positive progress. During the "14th Five-Year Plan" period, China's steel industry proposed to achieve carbon peak by 2025 and reduce carbon emissions by 30% by 2030。近年来,钢铁行业加大了环保投入,推进了超低排放改造,发布了碳中和愿景和低碳技术路线fig,开展了氢能冶炼、碳捕集利用与封存等技术试点,并建立了全生命周期绿色产品评价体系。同时,钢铁行业的低碳转型还存在着一些困难,如废钢资源的不足与利用率的低下,清洁能源的供应与替代能力的不足,新技术的成熟度与可靠性的不高,碳交易市场的规范化与完善程度的不够等。

(2) Carbon reduction progress in the new energy vehicle industry

The new energy vehicle industry is one of the important areas to achieve the dual carbon goals, and it is also a popular industry supported by policies and markets. Many NEV companies have also set clear carbon reduction goals and paths in their sustainable development. The EU is leading the way in climate action, with strict policies and regulations, so European automakers have clearer goals to address climate change and more comprehensive actions. As a rising star, China's new energy vehicle companies have also taken positive actions in recent years in the construction of zero-carbon factories and the promotion of carbon reduction in their own operations, but most of them still lack specific carbon reduction goals and plans.

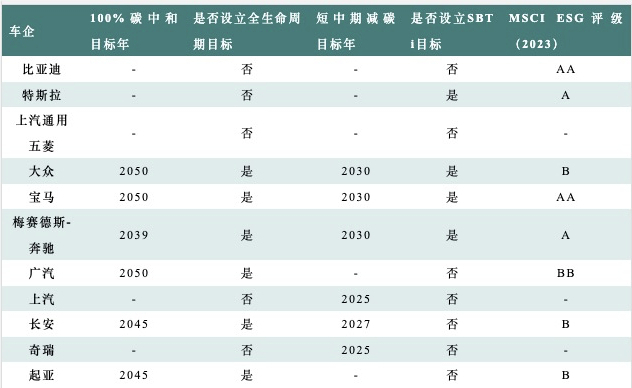

table2 Key carbon reduction information for advanced new energy vehicle companies at home and abroad

The main carbon reduction action measures of new energy vehicles can be divided into the production end, the product end and the operation end, and the cooperation with the steel industry is mainly focused on the production end.

table3 General carbon reduction links and measures of new energy vehicle companies

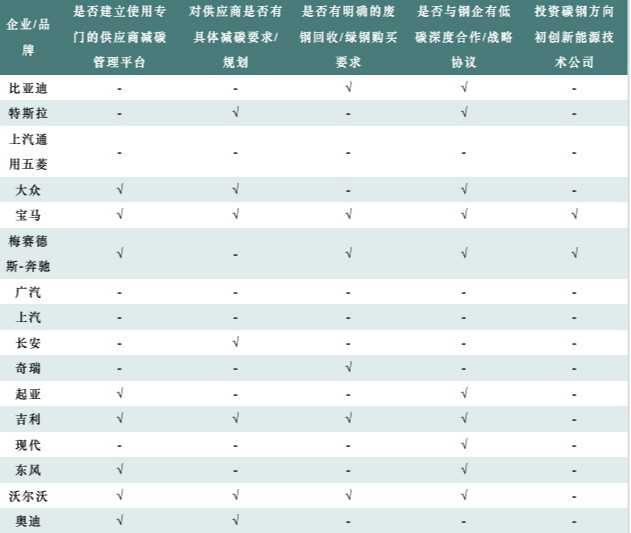

(3) The low-carbon requirements of new energy vehicle companies for steel

The role of new energy vehicle companies in reducing carbon emissions in the steel industry is mainly reflected in the process and mechanism of supplier management, and their carbon reduction requirements for the steel industry of upstream suppliers mainly include the following aspects: (1) establish and improve the steel recycling mechanism and improve the recycling rate of scrap steel; (2) give priority to the use of low-carbon steel, such as the use of recycled steel, green electricity, hydrogen and other methods to replace traditional blast furnace steelmaking; (3) improve the quality and efficiency of steel, reduce waste and energy consumption, such as the use of high-strength steel, (4) Strengthen the carbon accounting and management of the supply chain, establish carbon emission reduction targets and evaluation mechanisms, such as signing carbon neutrality commitments and participating in carbon emission trading, etc., (5) Reach in-depth strategic cooperation with steel enterprises or directly invest in new technology companies, and further increase the requirements for green steel.

table4 Current status of supply chain decarbonization of advanced new energy vehicle enterprises at home and abroad (mainly for steel)

Exploration of the Collaborative Carbon Reduction Cooperation Model between New Energy Vehicles and the Iron and Steel Industry: A Case Study

As an important part of carbon emissions, the supply chain is the focus of international car companies to promote decarbonization in the future, and the sustainable strategic cooperation between international new energy vehicle companies and steel enterprises is relatively deep, with various forms and clear low-carbon themes, and detailed requirements for carbon reduction of steel enterprises. The current carbon reduction actions of domestic new energy vehicle companies are more in increasing the recycling rate of raw materials and building zero-carbon factories to reduce carbon emissions from their own production and operation, and the work of supply chain emission reduction is still in the preliminary construction stage.

(1) Mercedes-Benz - Actively promote the decarbonization of the global steel supply chain

Mercedes-Benz has a lot of practical measures in low-carbon cooperation with steel suppliers, and is in a leading position in the cooperation between new energy vehicle companies and steel suppliers.

Back in 2020, Mercedes-Benz carsA letter of intent was sent to suppliers of production materials for climate-neutral products, agreeing to this letter of intent is now a precondition to the ruling. Since then, suppliers representing nearly 90% of Mercedes-Benz's annual procurement volume have signed the letter of intent, including significant steel suppliers. In addition, Mercedes-Benz has:Incorporate CO2 emission targets for key components into its comprehensive supply contract process criteria.This includes the production of CO2-intensive materials and components, such as steel, aluminum, and batteries. These targets apply not only to direct suppliers, but also to the upstream production of raw materials and components. At the same time, Mercedes-Benz is also active in promoting long-term changeParticipate in the development of industry-wide sustainability standards, such as the Responsible Steel Initiative (RSI).

table5 Mercedes-Benzof steel supply chain decarbonisation initiatives

(2) BMW - Cooperate with HBIS Group to build a "green steel" supply chain

In August 2022, the BMW Group and HBIS Group signed a contract in ShenyangMemorandum of Understanding on Building a Green and Low-Carbon Steel Supply Chainand work together to build a green and low-carbon automotive steel supply chain. Starting from mid-2023, HBIS's low-carbon automotive steel will be gradually used in production models at BMW's Shenyang production site. The production of these low-carbon automotive steels will produce 10 to 30 percent less CO2 than conventional steels. With the upgrading and iteration of innovative technologies in the steel industry, starting from 2026, BMW's Shenyang production base will start to use green automotive steel (hereinafter referred to as "green steel") produced by HBIS in the mass production process of vehicles.

These "green steels" are based on processes such as green electricity and electric furnaces, and their production processes will gradually reduce CO2 emissions by about 95%. According to the current procurement plan, BMW expects to reduce CO2 emissions by about 230,000 tons per year from 2026 onwards.The BMW Group is one of the first automakers in China to have a clear plan for the use of green automotive steel in mass production. The joint carbon reduction with the steel industry is an important progress of BMW after the launch of the "Green Transformation of the Industrial Chain" initiative, and it is also a breakthrough cooperation between the two industries in green transformation.

(三)北京Benz——与宝钢股份正式签署《打造绿色钢铁供应链合作备忘录》

2022年11月22日,北京Benz与宝钢股份以“云签约”方式正式签署《打造绿色钢铁供应链合作备忘录》,致力于在整车制造过程中使用更加清洁的原材料,共同打造绿色汽车钢铁供应链。本次战略合作将促进双方在生产制造全产业链和全生命周期的低碳减排,实现跨领域协同减碳,共同迈向绿色可持续未来,携手为应对全球气候变化做出实质贡献。

fig2北京Benz与宝钢股份正式签署《打造绿色钢铁供应链合作备忘录》

目前,北京Benz与宝钢股份在减碳产品及技术路径方面已达成一致意见。根据《备忘录》的内容,北京Benz将在2023年逐步使用碳排放强度大幅降低的低碳钢,从2026年起借助氢基竖炉-电炉的技术路径,其车辆用钢的碳排放强度将逐步降低50%-80%,随后还将使用减碳95%的绿钢。这条清晰明确的减碳路径,将加速推动北京Benz实现碳中和目标,同时驱动宝钢股份协同推进碳减排。据悉,宝钢股份氢基竖炉机组将于2023年建成投产,这将是我国首套百万吨级的集成氢气和焦炉煤气进行工业化生产的直接还原铁生产线,将进一步减少生产工艺上的碳排放,为北京Benz输送更绿色的超低碳汽车板。

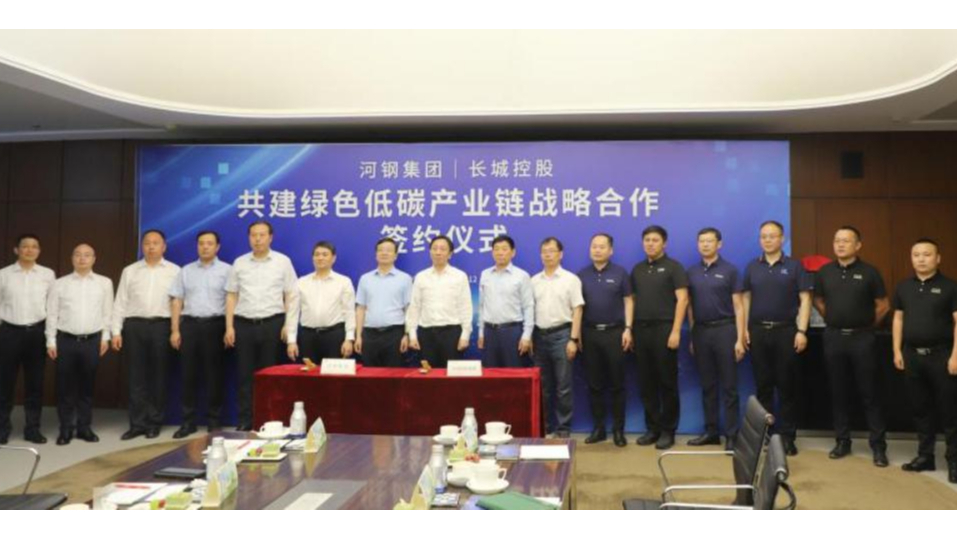

(iv)Great Wall - signed a strategic cooperation with HBIS Group to jointly build a green and low-carbon industrial chain

2023年6月12日,长城与河钢集团有限公司(以下简称“河钢集团”)正式签署《共建绿色低碳产业链战略合作协议》,双方将深入贯彻落实国家“双碳”战略部署,携手打造第一家国产品牌汽车绿色供应链,通过搭建绿色低碳供应链、共建氢能源产业生态,推进汽车钢铁产业链绿色低碳转型。河钢集团副总经理、长城首席战略官李毅仁,分别代table双方签署合作协议。

fig3The signing ceremony of the signing ceremony of strategic cooperation between Great Wall and HBIS Group

fig4Great Wall signed a strategic cooperation agreement with HBIS Group

According to the agreement, the two sides will give full play to the advantages of regional and industrial resources, focus on the ecological construction of the supply chain and the new energy industry chain, and carry out multi-field, in-depth and all-round cooperation. In terms of supply chain ecology, we will further deepen the foundation of supply chain cooperation, jointly build a technology innovation and research and development platform for automotive steel materials, jointly promote cooperation in the field of low-carbon automotive steel, and create a green and low-carbon steel industry chain ecosystem. In terms of the ecology of the new energy industry chain, as the main carrier of the hydrogen energy industry of Great Wall Holding Group in the field of new energy, Weishi Energy will join hands with HBIS Group to lay out hydrogen energy resources and development application scenarios in the Beijing-Tianjin-Hebei region, jointly build a new energy ecological management and control platform, create zero-carbon logistics solutions in Beijing-Tianjin-Hebei, and jointly develop high-end hydrogen energy equipment and core technologies, so as to accelerate the demonstration and promotion of hydrogen energy applications.

On August 11, 2023, the first batch of low-carbon automotive steels produced by Hangang Iron and Steel Company of HBIS Group based on the "blast furnace-converter" process and using hydrogen metallurgy technology and large scrap ratio rolled off the production line. The process focuses on the ultimate carbon reduction of the whole process, and by adding 30% of scrap steel and hydrogen metallurgical DRI raw materials, the comprehensive carbon reduction of the product exceeds 30%.

Future outlook

In recent years, China has adhered to the strategic orientation of pure electric drive, and the development of the new energy vehicle industry has made great achievements, becoming one of the important forces in the development and transformation of the world's automobile industry, and the next ten years are a critical period for the high-quality and sustainable development of China's new energy vehicle industry. According to the "New Energy Vehicle Industry Development Plan (2021-2035)", by 2025, the competitiveness of China's new energy vehicle market will be significantly enhanced, and the sales volume of new energy vehicles will reach about 20% of the total sales of new vehicles. By 2035, the core technology of China's new energy vehicles will reach the international advanced level, and the quality brand will have strong international competitiveness. Pure electric vehicles have become the mainstream of new sales vehicles, public vehicles have been fully electrified, fuel cell vehicles have been commercialized, highly autonomous vehicles have been applied on a large scale, the charging and swapping service network has been convenient and efficient, and the construction of a hydrogen fuel supply system has been steadily promoted.

As an important basic industry and strategic industry in China, the steel industry is also an important support for the upstream and downstream of the new energy vehicle industry chain. With the continuous expansion of the new energy vehicle market, higher quality requirements and innovation requirements have been put forward for products in the steel industry. If iron and steel enterprises want to seize the historic opportunities brought by new energy vehicles, they should make adjustments in many aspects:

(1) Product typeIron and steel enterprises should develop and produce steel varieties that meet different needs, such as low-carbon steel, high-strength steel, ultra-high-strength steel, high-toughness steel, corrosion-resistant steel, wear-resistant steel, etc., according to the different technical routes and application scenarios of new energy vehicles, so as to improve the performance advantages and market share of products.

(2) Innovation-driven:Iron and steel enterprises should strengthen their technological innovation capabilities, increase R&D investment, and form a cooperation mechanism with new energy vehicle enterprises and scientific research institutes to overcome the bottlenecks of key core technologies and products, improve product quality and stability, and promote the effective supply of high-end steel products.

(3) Low-carbon green:Iron and steel enterprises should accelerate the green and low-carbon transformation, adopt advanced production technology and equipment, improve energy efficiency, reduce carbon emission intensity, and achieve cleaner production and recycling. At the same time, iron and steel enterprises should also actively use the synergistic effect of the upstream and downstream of the new energy vehicle industry chain to promote green supply chain management and enhance their green competitiveness.

In short, new energy vehicles are a strategic choice for the high-quality development of China's automobile industry, and it is also the trend of green and low-carbon development. As an important support for the upstream and downstream of the new energy vehicle industry chain, the steel industry needs to keep up with the trend of the times, accelerate innovation and development, improve product quality and performance advantages, reduce resource consumption and environmental pollution, and achieve coordinated development and win-win development with the new energy vehicle industry.

(Author's Affiliation: Shanghai Qingyue)