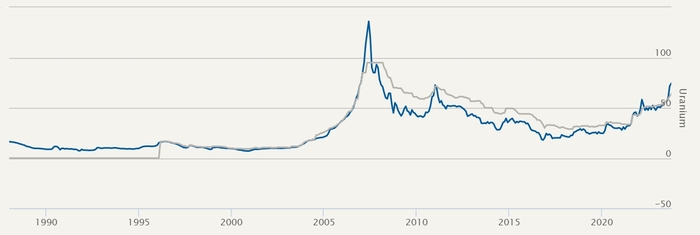

Breaking the $80 mark for the first time in 15 years, the metal's price has risen far more than gold this year

Nuclear power is back, and the uranium bull market is coming.

According to the official website of the Chicago Board of Trade (CME), on November 20, local time, the settlement price of uranium octaoxide futures for the month reached $80.25 per pound, breaking through $80 per pound for the first time in 15 years. The next day, the price continued to rise by $0.5/lb to $80.75/lb.

Uranium octaoxide is a stable uranium compound and the ubiquitous form of uranium in processing, known as "yellowcake".

Uranium could be one of the best-performing metals in the market this year. According to weekly data published by UxC, a market research firm for the nuclear industry, the price of uranium octaoxide has risen by more than 55% so far this year. In contrast, COMEX gold, or New York gold, rose just 8.4% for the year.

Bloomberg Intelligence said in October that the price of uranium had risen 125% since the end of 2020, and that uranium ETF assets had grown 20-fold over the same time period.

The rebound of the nuclear power industry, the lack of uranium ore supply, and the panic buying of global utilities,Stimulate the rising price of uranium。

After the Fukushima nuclear accident in 2011, uranium prices fell into a downturn, and miners slashed production capacity. According to the World Nuclear Association, global uranium production fell by 25% to 47,700 tonnes from 2016 to 2020, only to recover slightly to 49,400 tonnes last year.

This year, the coup in Niger, the world's seventh-largest uranium producer, has disrupted the uranium supply chain, and Cameco, the world's second-largest uranium producer, has reduced its production target due to mining challenges, both of which have increased pressure on uranium supply.

At the same time, under the global low-carbon transition and energy security issues, the return of nuclear power is accelerating, driving up uranium demand.

Since 2015, Japan has restarted 11 reactors, and 16 reactors are currently in the process of being restarted. Countries such as South Korea, France, the United Kingdom, the Netherlands, Finland, the Czech Republic and Poland have all supported the development of nuclear power.

China is also actively promoting the construction of nuclear power.There are 28 nuclear power units under construction, continue to maintain the world's No. 1. The 14th Five-Year Plan clearly states that the construction of coastal nuclear power should be promoted safely and prudently, and the installed capacity of nuclear power operation should reach 70 million kilowatts.

According to the World Nuclear Energy Association, there are currently 170 new reactors under construction or planned around the world.

A 1 million kilowatt unit requires about 200 tons of uranium ore a year. According to Reuters, UxC expects about 195 million pounds (about 88,500 tons) of uranium will be needed for 436 operational reactors worldwide in 2023, and there will be a uranium supply gap of 66 million pounds (about 30,000 tons).

In order to ensure energy security, countries have increased the importance of uranium. On November 20, China Securities Construction Investment released a research report mentioning that under the conflict between Russia and Ukraine, the gradual de-Russification trend in Europe and the United States is obvious. The European Union launched the "REPowerEU" energy transition plan, which is committed to improving the uranium conversion, enrichment and fuel manufacturing capacity of the Western camp; The U.S. Nuclear Security Administration (NNSA) has launched the Natural Uranium Strategic Reserve Procurement Program to support indigenous natural uranium production.

In the middle of last year, the U.S. Nuclear Security Administration (NNSA) launched the U.S. Strategic Uranium Stockpile process to purchase an estimated 1 million pounds (385 tons of uranium) of domestically produced uranium octa.

Nuclear utilities around the world are also scrambling to sign long-term contracts for uranium and push up uranium prices.

"It's important to note that the uranium price movement at many points this year has actually been driven by utilities, which are finally starting to replenish their stocks." John Ciampaglia, CEO of Split Asset Management, recently said in S&P Global Commodities that the 10-year destocking period is over.

According to the U.S. Energy Information Administration (EIA), U.S. utilities held 104 million pounds of uranium octaoxide at the end of 2022, down about 18.8% from their peak in 2016.

Sprot Asset Management believes that higher uranium prices may eventually prompt producers to restart production. In November, Australian mining company Boss Energy Ltd. announced the resumption of a project that had been shelved more than a decade ago.

However, it takes about 8-15 years for a uranium mine to produce uranium, and the gap between uranium supply and demand is likely to widen further in the future.

According to Reuters, SP Angel mining analyst John Meyer said the market has been gradually pushing prices higher as mining costs rise and nuclear power plants seek to build up inventories to cope with increasingly volatile supply issues.

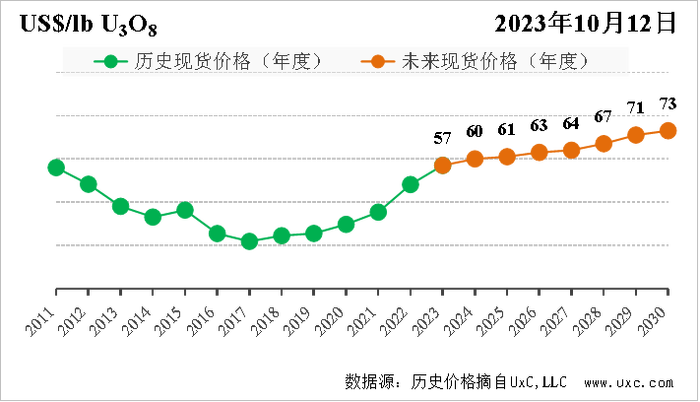

"It is expected that uranium prices will increase year by year over the next 10-20 years, or until another low-carbon, large-scale uninterruptible baseload power source is found globally." John Meyer said.

According to the Financial Times, Nick Lawson, chief executive of British investment firm Ocean Wall, predicted that the uranium spot price could rise to US$200/lb by 2025.

The China Nuclear Energy Industry Association predicted in November that in the medium and long term, the uranium stocks of European and American nuclear power companies are at a historical low, and at the same time, in order to reduce geopolitical risks, the number of long-term trade contracts signed by many nuclear power companies will increase, which will continue to raise long-term prices and stimulate spot price increases, until more primary supply is brought into the market to stabilize price increases.

"Looking ahead to the next three months, the persistently high spot price situation will be eased if uranium supply and demand remain fragile balanced, producers/traders are inactive in sourcing, and the long-term price drive is weakened. Spot natural uranium prices are expected to fluctuate between US$60 and US$70/lb over the next three months. The China Nuclear Energy Industry Association also said.