How to break the situation with only 1% of market-based transactions of green electricity?

"The market-based trading model of green electricity is more flexible. With the deepening of the reform of the electricity market, it is expected to become the most important way to consume renewable energy. ”

Lu Xin, director of Greenpeace's climate and energy program, made the above statement at the meeting of Greenpeace and Tsinghua University's Sichuan Energy Internet Research Institute, which was jointly released by Greenpeace and Tsinghua Sichuan Energy Internet Research Institute.

Under the "dual carbon" goal, increasing renewable energy consumption has become a top priority to promote China's energy transition. At present, the main forms of renewable energy consumption in China include market-based trading of green electricity, self-built distributed energy power stations by enterprises, and green certificate trading (separation of certificates and electricity).

Among them, the market-oriented trading of green electricity refers to the trading of green power products such as wind power and photovoltaic power under the framework of medium and long-term electricity trading, so as to meet the needs of power users to purchase and consume green electricity, and provide corresponding green power consumption certification, which is a model of "integration of certificate and electricity".

Renewable energy can also be traded through the spot market, and the spot pilot provinces of Shanxi, Gansu, Mengxi and Shandong have included renewable energy in the scope of spot electricity trading.

China's green power trading has been going on for more than two years, but trading activity is low. This year, domesticThe trading of green electricity and green certificates has doubledHowever, data from the China Electricity Council (CEC) shows that in the first half of this year, the trading volume of green electricity in the provincial market was 21.34 billion kilowatt hours, accounting for only 1% of the total electricity traded in the provincial market.

"At present, the proportion of market-based transactions of renewable energy is already high, but the transaction volume of green electricity special transactions is very small. Cai Yuanji, deputy director of the Institute of Electricity Market and Carbon Market of Tsinghua Sichuan Institute, pointed out that the scenario of green power consumption is not clear, the demand for green electricity has not been liberalized, and many companies buy wind and solar only because of the cheap price, and do not care about obtaining green certificates. Based on this, the environmental premium of renewable energy is not clear and reasonable.

For renewable energy power generators, the report also points out that the risk of power generation deviation faced by power generators will undoubtedly be further expanded in the new stage of shifting from comprehensive guaranteed purchase to full market-based trading.

This is mainly due to the volatility and uncertainty of renewable energy output, which cannot accurately control the output like traditional dispatchable thermal power units. In the market settlement process, renewable energy needs to settle the difference between its actual output curve and the declared amount of electricity before the clearance declaration.

According to the report, renewable energy companies and power users need to find a balance between the medium- and long-term power market and the spot market. On the one hand, the commodity price of electricity is discovered through the spot market, and on the other hand, the transaction contract is signed through the medium and long-term market, and the electricity price and trading volume in the contract period are locked in advance, so as to hedge the transaction risk caused by the fluctuation of electricity prices in the spot market with long-term foreseeable revenue or cost.

At present, some domestic enterprises are actively exploring the signing of long-term power purchase agreements for green electricity.

In October this year, Tongwei New Energy and CNOOC Power Investment signed a long-term bilateral agreement on green power, stipulating that the former will provide renewable electricity to CNOOC at the agreed price over a longer period. This is the first long-term green power transaction completed between domestic enterprises.

"Internet technology companies represented by Alibaba, Tencent, Qinhuai Data and GDS, as well as international chemical companies represented by BASF and Covestro, have also promoted the expansion of green electricity trading scale or piloted new green electricity trading models. The report said.

The report also mentions that long-term PPAs for green power are still in their infancy in China, and there are relatively few corporate practices and cases. According to the interviewees, the main reasons include the need to clarify the pricing mechanism and the technical threshold for the direct signing of the agreement between the developer and the user.

In terms of pricing mechanism, most renewable energy multi-year contracts still anchor the price of coal-fired power, which is certain for one year, which cannot reflect the power generation cost and environmental value of renewable energy, and it is difficult to play the role of avoiding long-term price increases.

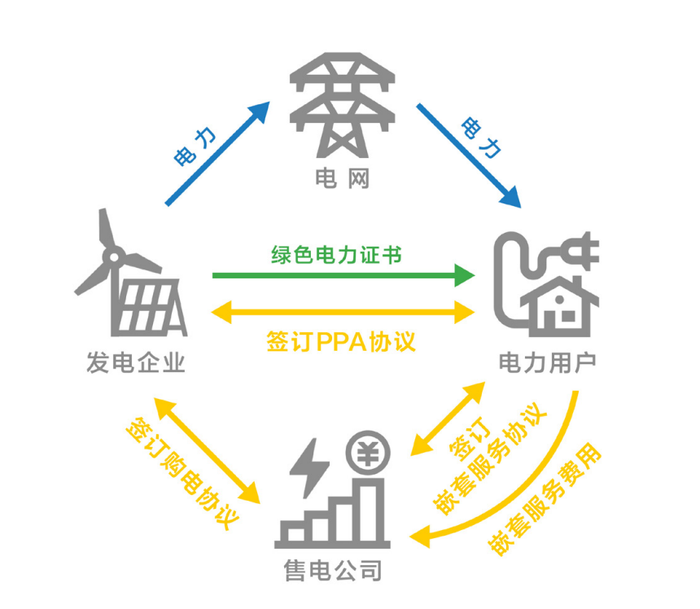

On this basis, the report introduces nested long-term power purchase agreements (SPPAs) as a new green power trading model. Under this model, the power consumer directly signs a bilateral power purchase agreement with the power generation company, and the power user signs a back-to-back mirror agreement with the power sales company, authorizing the power sales company to purchase balanced electricity for it and pay the corresponding management fee for it.

The report emphasizes that under this model, the two parties sign a transaction contract through the medium and long-term market, lock in the electricity price and trading volume during the contract cycle in advance, and hedge the transaction risk caused by possible electricity price fluctuations in the spot market with long-term foreseeable revenue or cost.

Cai Yuanji said that nested long-term power purchase agreements provide a new trading model for China's green power trading, which can give full play to the advantages of different entities under the framework of green power trading for many years, and reasonably reduce and effectively share the market risks of renewable energy trading.

"Promoting the SPPA will also help improve China's green electricity pricing system and answer the question of how much renewable energy can be worth in China. Cai Yuanji believes that the SPPA model can guide renewable energy and users to sign long-term contracts, and clarify the price of electricity and green environment. At the same time, through nested contracts, nested fees are used to cover deviations and balance costs, helping contracts to be executed effectively.

Unlike general long-term agreements, SPPA also uses electricity sales companies as intermediaries to provide load management and balancing services.

Sun Jing, deputy general manager of Heilan Power Co., Ltd., a power sales company, said at the meeting that the power sales company uses the SPPA model as an endorsement to balance the deviation between thermal power and green power, which not only gives the company benefits, but also brings certain challenges, such as the need to improve the ability to predict the power consumption on the user side and strengthen cooperation and communication with the power supply side.