The battle between long and short became more and more intense, and the Guangzhou Futures Exchange adjusted the lithium carbonate futures policy again

Interface News Reporter | Wang Yong

The market has not dispelled concerns about lithium carbonate futures deliverables, and futures prices are still volatile, and the Guangzhou Futures Exchange (hereinafter referred to as the Guangzhou Futures Exchange) has made another move.

On December 13, lithium carbonate futures ushered in a sharp fall and a big rise, the lowest position of the main contract 2401 was 89,600 yuan/ton, which was still down 5 minutes before closing, and ushered in a surge in the last five minutes, and finally closed at 108,550 yuan/ton, an increase of 10.94%.

In response to this market, the Guangzhou Futures Exchange issued a notice after the market on the same day, saying that after research, it was decided that from the settlement on December 13, the price limit of lithium carbonate futures contracts will be adjusted to 13%, and the trading margin standard will be adjusted to 14%; Among them, the trading margin standard of lithium carbonate futures LC2401 and LC2402 contracts is adjusted to 15%.

This is the second time that the Guangzhou Futures Exchange has recently adjusted the price limit of lithium carbonate futures, and it is only three working days after the last time. Its initial price limit is in the range of 7%, and the trading margin standard is 9%; On December 8, the price limit was adjusted to 10%, and the trading margin standard was 12%.

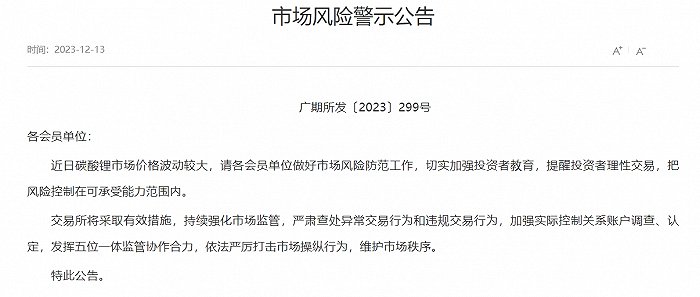

In addition, the Guangzhou Futures Exchange issued another market risk warning announcement, saying that the price of lithium carbonate market has fluctuated greatly recently, and all member units are requested to do a good job in market risk prevention, effectively strengthen investor education, remind investors to trade rationally, and control risks within the range of tolerance.

Guangfu said that it will take effective measures to continue to strengthen market supervision, seriously investigate and deal with abnormal trading behaviors and illegal trading behaviors, strengthen the investigation and identification of accounts with actual control relationships, give full play to the joint force of five-in-one supervision and cooperation, severely crack down on market manipulation in accordance with the law, and maintain market order.

On December 8, when the price limit was adjusted for the first time, the Guangzhou Futures Exchange also issued a market risk warning announcement, saying that all member units should further strengthen investor education, explain the rules thoroughly and the risks according to the characteristics of lithium carbonate futures, remind investors to participate in transactions in accordance with regulations, cautiously and rationally, effectively avoid blindly following the trend, and control the risks within the range of tolerance; At the same time, it is necessary to effectively strengthen the compliance supervision and risk prevention of customer trading behavior.

There have been private equity firms that have fallen behind in the lithium carbonate market. Xiangchu Fund issued a "Letter to Investors" on December 11, saying that on December 7, the abnormal fluctuation of lithium carbonate targets, insufficient market expectations for new targets, and some products caused a sharp drawdown.

The fund said that in order to express its apology, it decided that the related products involved this time will not receive any performance remuneration during the period from the drawdown repair to the net value on December 6, 2023. It can be seen that the current risk of lithium carbonate is beyond the control of ordinary institutions.

The sharp rise and fall of lithium carbonate futures is the embodiment of the long and short game entering a critical period, and it is also a game of delivery logic behind it.

WIND data shows that as of December 13, Guotai Junan, GF Futures, and CITIC Futures are the top three shorts; Soochow Futures, Oriental Wealth Futures, and Zhongcai Futures are the top three bulls.

Xinhu Futures said that the core logic of recent market transactions is the delivery logic, and the news and warehouse receipt data of the Guangzhou Futures Exchange have a greater impact on the market. In view of the sharp reduction of positions the day before yesterday and the fact that there is still half a month before the last limit date, it is expected that the problem of insufficient deliverables will be solved, and it is unlikely that the position of the 2401 contract will decline steadily.

For the number of warehouse receipts registered, the agency's data shows that as of yesterday, the volume of lithium carbonate warehouse receipts was 510 tons, which is still at a low level. In view of the fact that it takes a certain amount of time for the registration of warehouse receipts, it is expected that the volume of warehouse receipts disclosed by the broad futures may begin to grow exponentially on a certain day, and it is necessary to continue to pay attention to it in the future.

In the delivery logic, the issue of deliverable standards has attracted market attention today. It is reported on the Internet that the lithium carbonate of Qinghai Salt Lake Lanke Lithium, a subsidiary of Salt Lake Co., Ltd. (000792.SZ), does not meet the delivery standard. Later, according to Sina Futures, the news was old news in August, and Qinghai Salt Lake Lanke Lithium did not apply for delivery in the future.

The Guangzhou Futures Exchange said on December 6 that the benchmark delivery of lithium carbonate futures is positioned as battery-grade lithium carbonate, and the content of magnetic substances is tightened from 3000ppb (concentration unit) in the industry standard to 300ppb, and in view of the characteristics of lithium carbonate boron and fluorine produced from salt lake brine and lepidolite raw materials, the requirements for boron and fluorine and other indicators have been increased, and the loss on ignition index has been added, and the requirements for chlorine, calcium and potassium have been adjusted, so as to better meet the quality characteristics of battery-grade lithium carbonate currently circulating in the spot market.

In addition to the delivery criteria, COFCO Futures also pointed out the concerns of lithium carbonate futures when entering the downstream market, including industrial characteristics, price differentials between raw materials and quality assurance.

The agency pointed out that the product needs a certification cycle, and each product of the cathode factory is suitable for different brands of lithium carbonate, which has been in the bill of materials.

"There is no brand restriction on the delivery of the Guangzhou Futures Exchange, and if the downstream wants to use it directly, I don't know where I can match the goods and whether I can use them when I buy them, which is full of unknowns." COFCO Futures said.

Under the current market, the price of spodumene electric carbon is stronger than that of recycled electric carbon, and the proportion of large factories is higher. This means that less carbon energy from mining electricity flows into the delivery market; Factory-to-factory will provide longer-term quality assurance, and it is difficult to track and process through warehouse receipt delivery.

The trading day of the lithium carbonate futures 2401 contract has entered the countdown of the last month, and the last trading day is January 15, 2024; The delivery date is the next three trading days.

On December 13, Jiemian News called Salt Lake Co., Ltd., the parent company of Lanke Lithium, on the issue of delivery standards, but the phone could not be connected.