In 2024, the top 10 predictions in the global energy field + the top 10 new hot industry predictions. See which one is right for you?

01.

Global solar growth will pass

Speed bumps

The total installed capacity of solar power generation in the world will continue to grow rapidly and continuously over the next decade, but the growth of installed solar power capacity in 2024 will be challenging compared to the pace of recent years. Wood Mackenzie 2022 predicts an average annual growth rate of 28% in 2019~2023, of which the growth rate in 2023 is 56%. Based on this forecast, Wood Mackenzie believes that in 2024~2028, the average annual growth rate of the total installed capacity of global solar power generation will tend to be close to zero, and there will even be negative growth in a few years.

The global solar market will show a typical S-shaped growth curve, that is, there will be a significant and rapid growth in the past few years, but starting in 2024, there will be an inflection point and slower growth. The solar market will be many times larger than it was a few years ago, but as the industry matures, it will follow a typical growth path. Nonetheless, the trend is not consistent across regions, such as Africa and the Middle East, which are still far from reaching an inflection point in growth, while Asia-Pacific and Europe, with China as the focus, will confirm this trend.

However, compared with the global market, China still has a distinct advantage in terms of the cost performance of photovoltaic modules. However, behind the price advantage, along with the rapid development of the industry, there is also the situation of "extreme involution" and overcapacity of players in the industry.

02.

Nuclear power is in the ascendant

will continue to be on national policy agendas

In 2024, nuclear power will win widespread support for the first time in more than half a century as a key solution to the world's energy crisis.

Compared to renewables and fossil fuel power generation, nuclear power has and still faces challenges of public acceptance and economic competitiveness. But in theory, it's the only reliable, dispatchable, plug-and-play "perfect" power generation solution with a small carbon footprint.

Nuclear energy is seen as the only reliable, dispatchable, plug-and-play, zero-carbon power generation solution that is reliable, dispatchable, has a small carbon footprint, and is therefore expected to gain broad support in 2024 and become a key solution to the world's energy shortage for the first time in more than half a century.

However, compared to renewables and fossil fuel power generation, nuclear power has been facing challenges in terms of public acceptance and economic competitiveness, especially Japan's discharge of nuclear wastewater, which has sparked strong opposition in Northeast Asia, and the consequences are not yet predictable.

03.

The game between zero-carbon goals and supply chain security

Is natural gas to the left? or to the right?

The energy shortage caused by the geopolitical conflict in Europe has made energy security a priority for all countries. In both 2022 and 2023, more than 65 million tonnes of liquefied natural gas (LNG) purchase and sale agreements were signed by natural gas end-users each year. In terms of the scale of existing investments and the expected market rebalancing, the growth rate of new LNG investment will slow down in 2024. As a fossil fuel, natural gas is still the form of energy that governments around the world will eventually get rid of in their energy transition, but as the most widely accepted "transition fuel", natural gas will continue to play an important role in ensuring energy security for some time.

Against this backdrop, businesses and governments will be more cautious in making investment decisions, and some investments may slow down further as a result. Oil and gas companies or other industry players need to recalibrate their portfolios and strategies to address the contradictions and possible consequences of global demand for natural gas.

04.

Non-OPEC oil production growth has slowed

Ease the pressure on OPEC+ countries

Next year (2024), the growth rate of oil production in non-OPEC countries is expected to slow to just 800,000 b/d.

The biggest factor expected for the slowdown is that U.S. oil production growth will slow sharply next year, but other countries, including Brazil, will also slow down. The economic slowdown in non-OPEC countries will ease the pressure on OPEC+ countries to cut production in 2023. After all, in the past 2023, the rapid growth of crude oil production in the United States has offset much of the efforts of OPEC+ countries to push prices higher by coordinating supply reductions.

Of course, one of the risk considerations for this view is the surge in US oil production, which we will analyze in the next one.

05.

"Four or two dialing a thousand pounds":

U.S. oil and gas producers

Seek to leverage more output with less

Some analysts believe that next year, the most popular macro story for the U.S. oil and gas industry may be that soaring production is no longer a sure thing. In 2024, it expects total upstream capital spending to decline for the second consecutive year in the 48 contiguous states. But at the same time, total oil and gas production in 48 states will continue to rise slightly, setting new records for each.

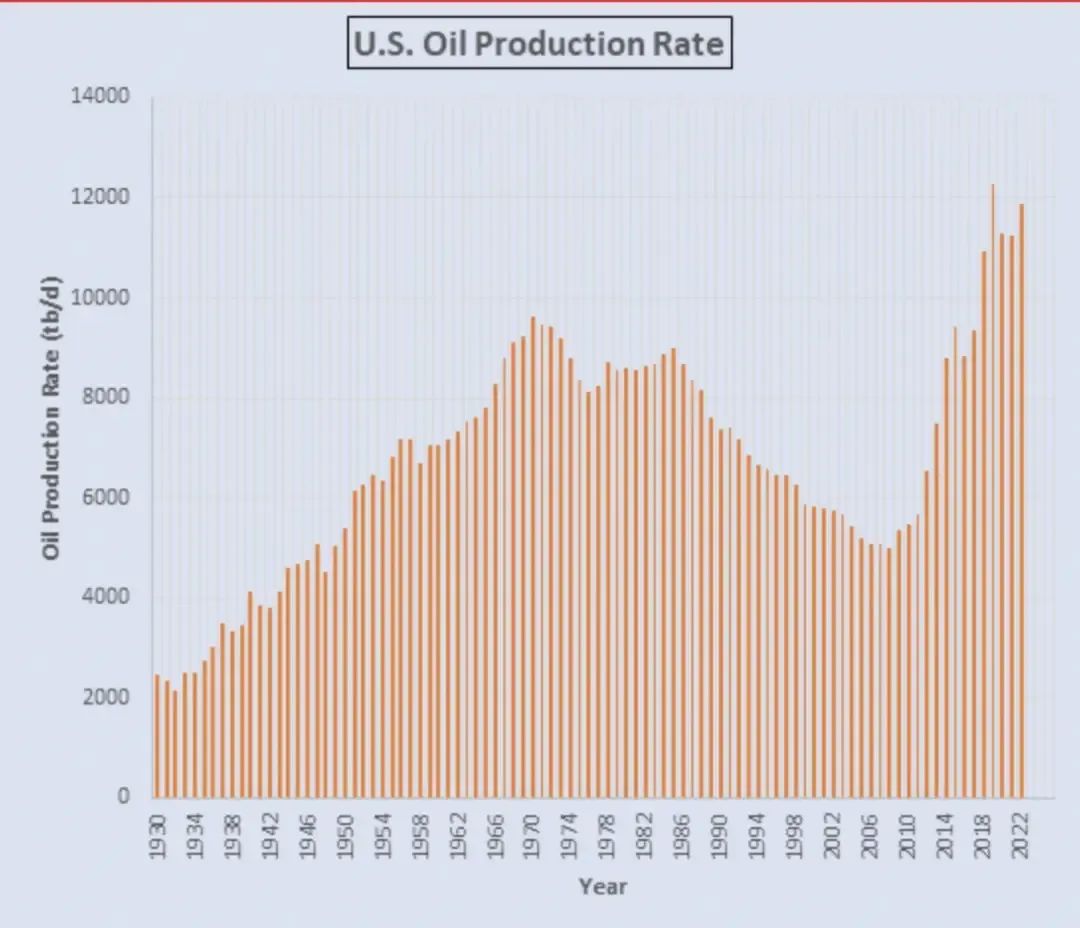

U.S. Oil Production Efficiency 1930-2022

Since its peak in late 2022, the number of oil rigs in the U.S. has been declining by 21%. Although the number of rigs will decrease, production will continue to rise slightly in the short term, benefiting from advances in extraction technology. Still, all sorts of clues are a reminder that the United StatesShale oilThe first dew of oil is exhausted, and the lamp is dry.

In 2024, the efficiency gains in the U.S. oil and gas industry will continue. Total upstream capex is expected to decline for the second consecutive year in the 48 contiguous states. At the same time, total oil and gas production in some of its home states will continue to rise slightly. The decline in rig count will be more than offset by continuous improvements in drilling speed, cycle, completion efficiency and project execution.

06.

The U.S. oil and gas industry has seen a wave of mergers and acquisitions

Since investors began to shift their focus from production growth to cash distribution, E&P's geographically focused business model has faded.

As companies seek to build more resilient financial platforms, large-scale M&A is increasingly aimed at diversification. Internationalization is undoubtedly a logical choice under this strategy. Strong equity currencies in the U.S. are attractive to overseas targets, and a new wave of mergers and acquisitions in the oil and gas industry is emerging.

In recent years, most investors have given up the pursuit of oil and gas production growth and instead focused on cash returns, and the original oil and gas exploration and development model with geographical location and reservoir zone as the core has become a thing of the past. The merger of large U.S. oil and gas companies with international oil companies may become a trend to watch.

Many analysts believe that the consolidation of the U.S. oil and gas industry will continue next year. On the one hand, the number of players in the oil and gas industry will decrease, and production technology and resources will be concentrated in the giants. On the other hand, the U.S. oil and gas industry will gradually transition from an era dominated by small- and medium-sized, growth-seeking producers to an era dominated by large oil and gas companies.

At the moment when large enterprises start "epic mergers and acquisitions", a new round of "era of uncertainty" is coming. The market is confusing, and the future of human energy is still in the torrent of drastic changes. The opportunity to change is tempting large producers to swallow up more smaller-scale independent firms, which are facing a severe impact of declining demand in the face of the increasingly economical large-scale mining and production technologies of large companies.

Is it to stubbornly resist and survive, or to join forces to protect one's self and strength? In 2024, more companies will give their own answers.

07.

Crossing the blue hydrogen

Straight to the future of green hydrogen

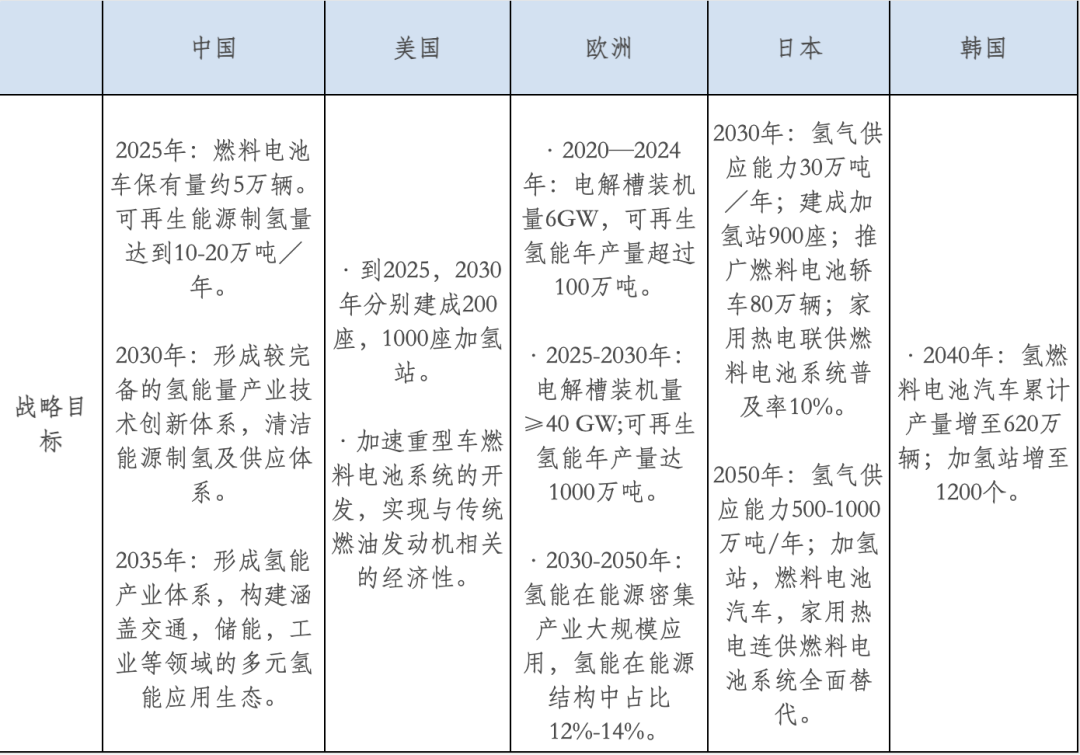

Ambitions for hydrogen around the world are reflected in policy and corporate project development. At the policy level, 17 countries around the world have proposed a complete strategy for hydrogen energy development.

Source: Chebai Think Tank, China Hydrogen Alliance, International Hydrogen Energy Association, IEA

From the perspective of the upstream of the hydrogen energy industry chain, there are four main measures for the preparation of hydrogen. Among them, the most environmentally friendly and ultimate form is green hydrogen (water electrolysis to hydrogen), that is, hydrogen production from water electrolysis with zero carbon emissions.

According to the current policies of governments and the progress of project development by enterprises, all countries are optimistic about low-carbon hydrogen projects, especially hydrogen energy obtained through water electrolysis powered by renewable energy. Despite this, there are still major obstacles to the technical roadmap of green hydrogen, and further research is needed by technical personnel to accelerate the progress of green hydrogen projects.

Green hydrogen projects now face two major challenges: one is that they are still not cost-competitive enough, and the other is that they cannot effectively lock in buyers. Most of the hydrogen projects that can make a final investment decision in 2024 will be those that already have "reliable" buyers or use hydrogen as a feedstock. While other hydrogen projects are difficult to compete with traditional fossil fuels in terms of cost, blue hydrogen projects will benefit from cost and scale advantages to be invested and slowly rolled out.

08.

over the mountains and mountains,

The carbon trading market will usher in the dawn

In 2023, the carbon trading market has reached a crossroads, with market activity begging for clarity due to a loss of confidence and buyers craving clarity.

The failure of COP28 to agree on Article 6* led to another setback in market sentiment. The situation is grim, but it can also be pre-dawn darkness, and the market is forced to clear low-quality offset products.

*Article 6 refers to Article 6 of the Paris Agreement, which mainly deals with the operation of the international carbon market and how emission reductions are transferred between countries. Under Article 6, there are two market-based mechanisms, namely the cooperative approach under Article 6.2 and 6.8 and the mechanism under Article 6.4, to facilitate Parties to further scale up their emission reduction efforts and achieve overall global emission reduction targets at a lower cost.

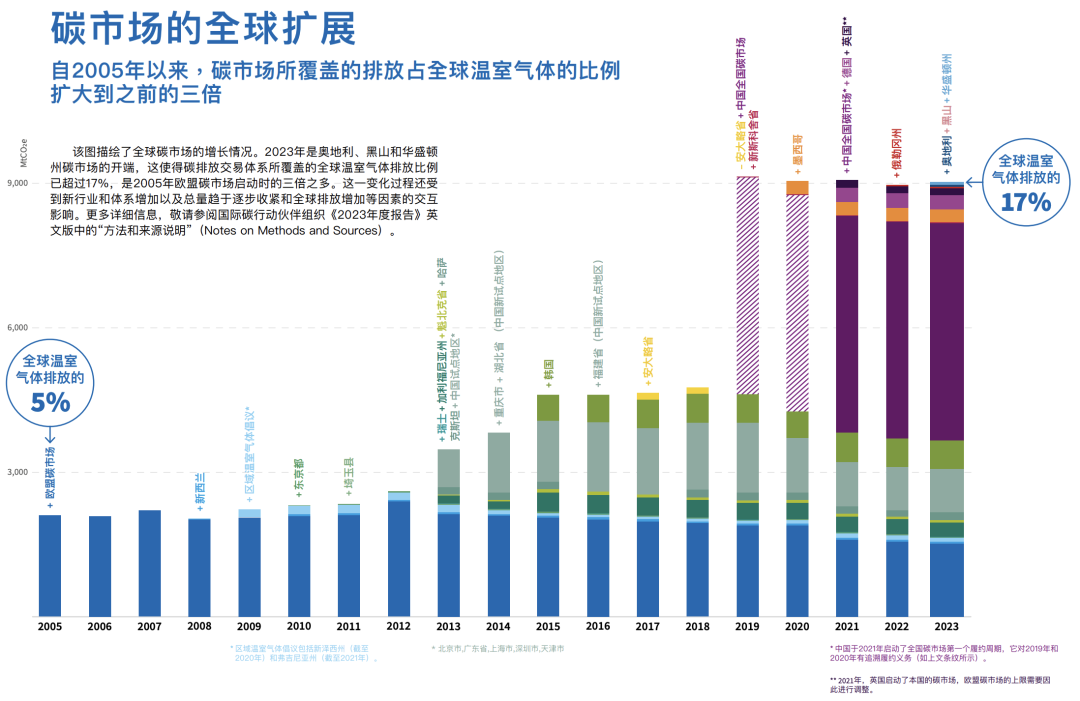

At present, the global carbon market includes supranational carbon markets, national carbon markets and regional carbon markets. Since 2005, the proportion of global greenhouse gases covered by the carbon market has tripled, and China's national carbon market is the largest in the world.

Growth of the global carbon market (click to enlarge the image)

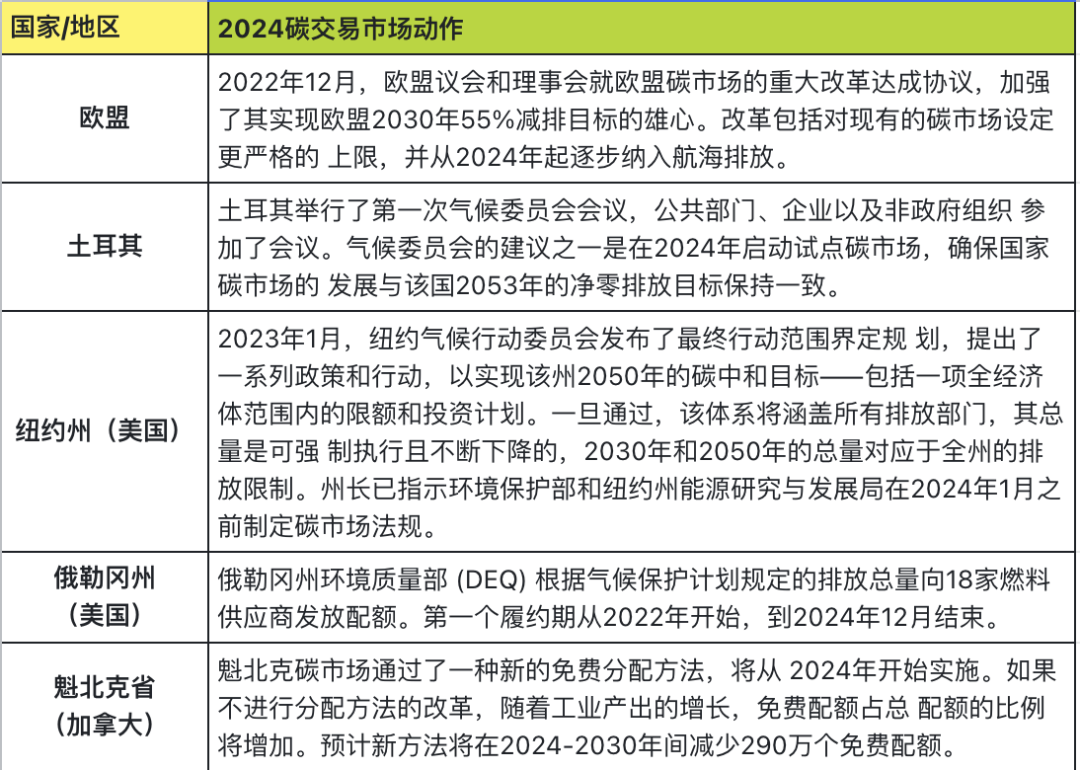

In the absence of centralized United Nations oversight, a number of independent governing bodies are developing guidelines and providing clear information. We expect to see the fruits of these efforts in 2024. Below, the author has compiled some of the policies/plans proposed by countries around the world for the 2024 carbon trading market.

09.

New carbon capture technology

Finally entered the scale of commercialization

In 2024, let's look back at the past before we look at new carbon capture projects. PreviouslyWood MackenzieIt has tracked up to 100+ commercial-scale carbon capture projects, and so far, about 50 of them have made considerable progress.

Of course, the main concern is the new technology from pilot to commercial scale. New technologies for capturing CO2, such as modularity, solid adsorption and biorecycling, will be fully deployed for the first time in 2024. These new technologies are expected to reduce energy consumption and reduce costs by up to 50% compared to existing methods. If successful, emissions from heavy industries such as construction and chemicals will be significantly reduced, and carbon capture technology companies are likely to receive a large number of orders.

At present, the requirements for energy conservation and emission reduction are still in the top-down promotion stage. Overseas, the UK Emissions Trading Scheme Authority announced a package of ETS (Emissions Trading SystemReforms: Confirm new emission limits for the power sector, energy-intensive industries and aviation from 2024, and extend the caps to more UK sectors, including maritime, waste and aviation.

Turning their attention back to China, at present, PetroChina, Sinopec, CNOOC and other enterprises have launched carbon capture projects, includingSongliao BasinThe 3 million ton carbon capture, utilization and storage demonstration project, the Shengli Oilfield million-ton carbon capture, utilization and storage project, etc., China's "carbon capture, utilization and storage" industry has entered the fast lane of development from a new strategy to a new pattern.

10.

What's next?

Geoengineering

In the conclusion of the first global stocktake at COP28, countries acknowledged that the remaining global carbon budget is shrinking rapidly, in other words, there is a risk that global temperature rise will exceed the 1.5°C target. This means that hundreds of billions of tonnes of carbon dioxide need to be removed/captured and stored in order to get the world back on track to the 1.5°C target by 2100.

Geoengineering技术(geoengineering)*,即为应对地球气候变化及其影响,对地球的环境、气候进行认为干涉而采取的超大型工程。其可用于提高地球的碳吸收能力,并将阳光反射回太空,帮助保持地球凉爽。例如,气溶胶或其他化学物质可以释放到大气中几公里,从而让地球表面反射更多的阳光,以缓解温度的升高。

*Geoengineering方案主要包括9种:碳捕捉、强化风蚀、造林、平流层喷雾、太空反射镜、造云翻着、生物碳、海洋施肥和地表反射。

实验性的Geoengineering计划目前正在大规模地扩散。事实上,在牛津大学、哈佛大学和维多利亚大学等主要大学都设置了专门的研究中心。在国际层面上,联合国和其他国际机构呼吁在该领域进行先进的研究。

The same is true for the United States. According to MIT Technology Review, "the U.S. government is developing a federal solar geoengineering research program."

在印度、中国、越南,关于Geoengineering的辩论正在激烈进行。同时,Geoengineering项目也是石油和天然气公司最感兴趣的。在碳捕获领域尤其如此。

此外,Geoengineering项目正在与其他领域交织在一起,如采矿、空间探索和卫星安装。不可忽视的是,人工智能已经深入到了这些项目中(在采矿、太空、地质技术和地质工程中应用)。

但对于Geoengineering,我们必须保持辩证的审慎态度。由于Geoengineering系统将是 "绝境中的绝招",这个概念引出了"下一步是什么"的地缘政治问题:"Geoengineering之后的气候危机该如何处理?"