Li Xuran: Innovative financial models help the "dual carbon" strategy

On November 29, the Center for Sustainable Development Research of Fudan University released the results of the Fudan Carbon Price Index for December 2023. The special guest of the conference is Dr. Li Xuran, Executive Director of China Galaxy International Financial Holdings Company and Head of the Dual Carbon Innovation Center. Dr. Li Xuran introduced the global action on climate change and the carbon market mechanism, focusing on the model of financial innovation under the "dual carbon" goal.

For a long time, China, the United States, Europe and other major countries have continued to play the role of economic "growth poles" and become the engine driving global development. However, in recent years, the intensification of international strategic games has led to the emergence of problems such as interest rate inversion and global trade imbalances, which have brought great challenges to the development of Chinese enterprises. Therefore, China should give full play to its responsibilities as a major country, take the initiative to adapt to the new situation, and continuously improve its voice in the field of international carbon governance. Specifically, we should start from the following three aspects:

(1) Establish a cooperation mechanism for climate governance in developing countries: Incorporate climate governance and carbon tax issues into the scope of cooperation among countries along the Belt and Road, establish a carbon emission market cooperation mechanism between "South-South" countries, build an ecological platform, and strengthen green and low-carbon cooperation under the "South-South" framework.

(2) Accelerate the study of the trade structure of export products: accelerate the establishment of a unified and standardized carbon emission statistical accounting system, establish a basic database of carbon emissions of China's export products, and improve the carbon footprint measurement system of export products, so as to provide sufficient data basis for the policy game of carbon tariffs in Western countries and the formulation of countermeasures.

(3) Actively grasp the right to speak on carbon asset pricing: establish a price stabilization mechanism for the carbon emission trading market, prudently introduce carbon financial instruments such as carbon futures, gradually build a carbon credit system, and give full play to its price discovery and risk hedging functions, so as to enhance the international recognition of China's carbon emission trading market and explore the connection path with the international carbon emission trading market.

According to a report released by TMR, the carbon market is expected to reach $4.8 trillion by 2031, and the global battle for carbon asset pricing power will become increasingly fierce. At present, many countries have preemptively introduced carbon tariffs, such as the European Union's Carbon Border Adjustment Mechanism (CBAM) and the United States' carbon tariffs on fossil fuel imports. Dr. Li pointed out that in the complex international game, China should take the development of green economy as an important starting point and grasp the new opportunities of green development. This will not only create new economic growth points, but also help promote the internationalization of the renminbi.

The implementation process of the EU Carbon Border Adjustment Mechanism (CBAM).

Carbon neutrality holds huge development potential and opportunities. The national carbon market has been online for more than two years, with a cumulative turnover of more than 20 billion yuan, and the overall market operation is stable and orderly, and the incentive and restraint effect on enterprises has initially appeared. In the future, more industries will be included, the coverage of the national carbon market will be expanded in an orderly manner, and a multi-level carbon trading market will be gradually built with the national carbon market as the core and voluntary emission reduction trading as the supplement. In this context, financial institutions have also accelerated the adjustment of business structure and laid out the carbon emission trading market in advance.

The transition to a carbon-neutral economy will also bring huge investment opportunities to low-carbon industries. Increasing the proportion of renewable energy and promoting energy conservation and emission reduction in the industrial sector are important directions for China's industrial transformation. In this process, the green transformation of energy will be significantly accelerated, wind power, hydrogen energy and other industries and related equipment manufacturing, big data platforms will usher in major development, and zero-carbon buildings and zero-carbon demonstration parks will also usher in large-scale promotion.

Carbon neutrality will also give rise to new financial formats, providing a broad space for the financial industry to carry out green and low-carbon businesses. In October 2020, China issued the "Guiding Opinions on Promoting Investment and Financing in Response to Climate Change", which specifically proposed to expand the regional pilot work of green finance. Green credit, green bonds, ESG investment funds, etc. are all financial products favored by policies and the market, and carbon financial instruments will usher in important development opportunities.

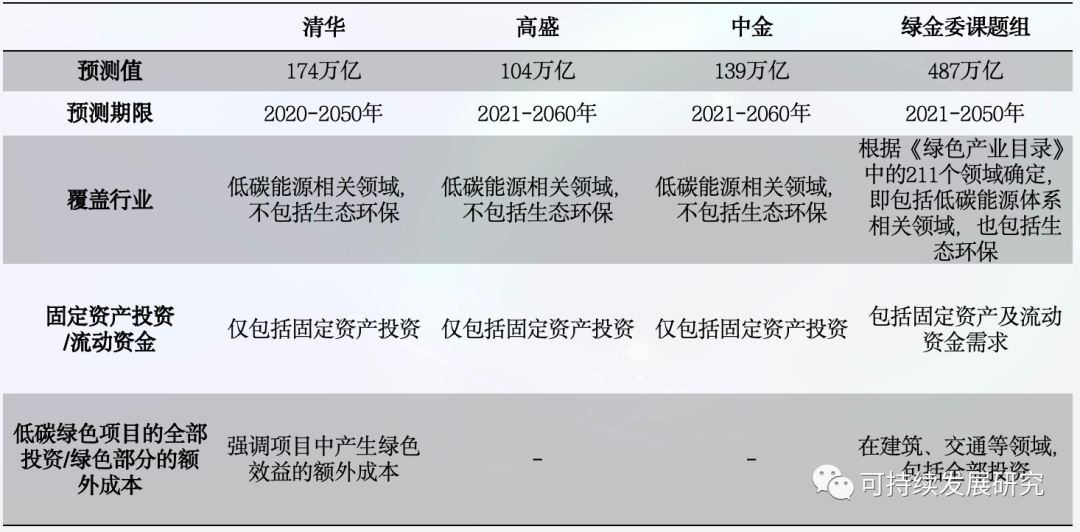

Comparison of Estimation Results and Caliber of Green and Low-carbon Investment Demand of Different Institutions (Unit: RMB)

According to the predictions of different institutions, the gap in China's demand for green and low-carbon investment in the next 30 to 40 years will be between 100 trillion and 500 trillion yuan. The securities industry can actively participate in it by providing carbon financial advisory services, carrying out climate investment and financing, and developing and trading carbon assets. Dr. Li discussed the model of financial innovation under the "dual carbon" goal by presenting cases such as Galaxy cross-border carbon emission swap, cross-border sales of "one yuan carbon sink", and CIMB FTSE Asia Pacific Low Carbon Index ETF.

Case 1:

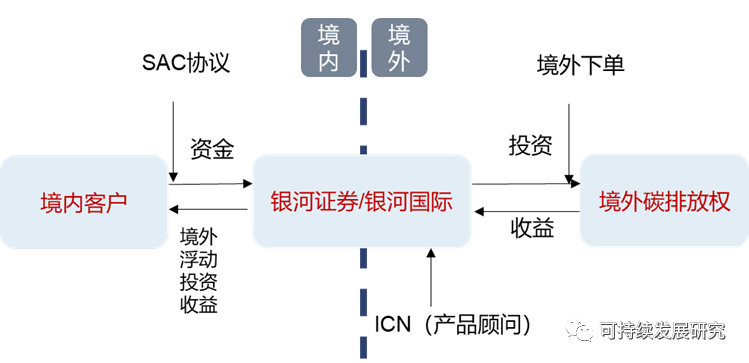

Galaxy cross-border carbon emission rights swap

In view of the risks brought by EU carbon tariffs to Chinese exporters and the pain points of enterprises participating in domestic and foreign carbon market transactions, China Galaxy International Holdings Co., Ltd. has designed a cross-border carbon return swap (TRS) product for EU carbon emission futures contracts, which allows domestic institutional customers to directly participate in EU carbon market transactions without leaving the country. Cross-border income swap (TRS) refers to back-to-back income swap transactions between investment advisory institutions and domestic customers and overseas institutions after receiving the advance payment from customers. During the agreement period, the parties to the transaction will exchange with reference to the full profit and loss of the assets, and the principal exchange and physical delivery generally do not occur. The project innovatively combines cross-border TRS and carbon futures, providing domestic customers with a channel to participate in overseas carbon trading.

Structure of Galaxy Cross-border Carbon Futures TRS Investment Model

Case 2:

Cross-border sales of "one-yuan carbon sinks".

Pioneered in 2019 by Shunchang County, Nanping City, Fujian Province, the "One Yuan Carbon Sequestration" project is a carbon sequestration project that breaks the problem of carbon sequestration forest development from poverty alleviation villages and poverty alleviation households, and implements a carbon sequestration project with towns and towns packaging forest land and trees owned by poverty alleviation villages and poverty alleviation households. Overseas sales are of great significance to further expand the sales channels of "one yuan carbon sink" and enhance the popularity of "one yuan carbon sink". In December 2022, Shunchang State-owned Forest Farm signed the "Exclusive Agency Agreement on "One Yuan Carbon Sink" with Galaxy International to assist in the promotion, consulting, cooperation and other services of the "One Yuan Carbon Sink" project overseas, actively break through technical bottlenecks such as international transaction exchange rate conversion, and better integrate with the international and domestic markets.

Case 3:

CSOP Galaxy-CIMB FTSE

Asia-Pacific Low Carbon Index ETF (SZSE)

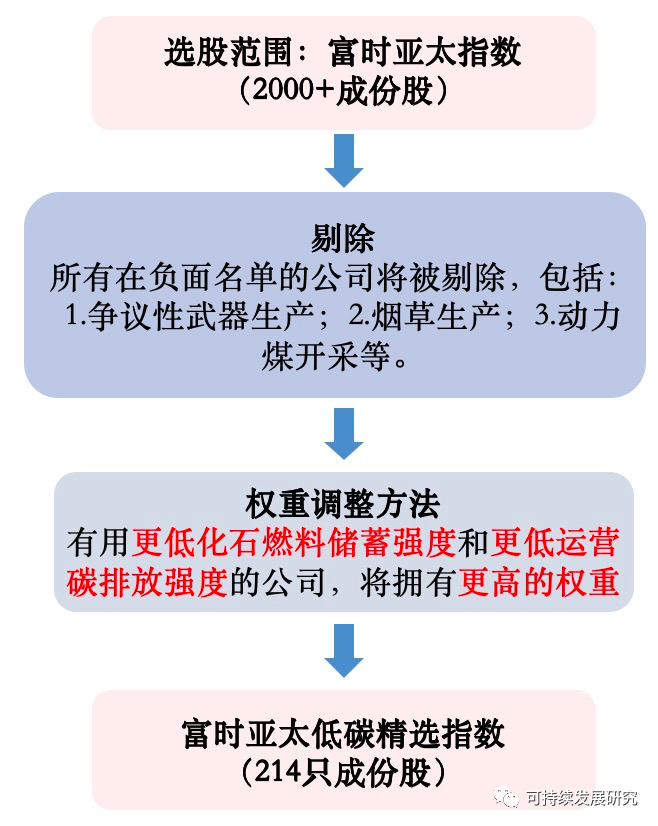

In September 2022, CSOP Galaxy-CIMB FTSE Asia Pacific Low Carbon Index ETF was simultaneously listed on the Shenzhen Stock Exchange and the Singapore Exchange, making it the world's first low-carbon ETF covering the Asia-Pacific region. The FTSE Asia Pacific Low Carbon Select Index is designed to reflect the performance of large-cap and mid-cap stocks in the Asia-Pacific market, with increased investment weighting in companies with low-carbon characteristics, adjusted based on the performance of the company's operational carbon intensity and fossil fuel savings intensity. The index includes 214 large and medium-sized stocks listed on 13 exchanges in 11 Asia-Pacific economies, covering a wide range of high-quality leading enterprises in countries and regions that are currently less covered by domestic ETFs, mainly investing in China and Asian countries and regions along the "Belt and Road". This will help investors fully tap the growth potential of the Asia-Pacific region and actively promote China-ASEAN financial cooperation and the implementation of the "dual carbon" goals.

Composition of the FTSE Asia Pacific Low Carbon Select Index

Dr. Li stressed that in the context of carbon neutrality, we should pay more attention to the financial risks related to climate change, mainly including transition risks and physical risks. Transition risks arise from factors such as policy changes and technological breakthroughs in response to physical risks, which originate from various climate disasters and extreme weather events caused by climate change, which affect the asset value and production and operation activities of enterprises through the destruction of physical assets and infrastructure. Financial institutions and enterprises should attach great importance to analyzing and preventing climate risks, and comprehensively address climate transition risks in the context of carbon neutrality by formulating a clear strategic roadmap, improving the level of relevant financial information disclosure, and measuring brown asset exposure.